Opening your own brokerage is a huge milestone in your real estate career. However, if you don’t accurately estimate your real estate brokerage expenses, your startup dream can quickly become a nightmare.

I learned this from experience. In my 28-year career in real estate, I have launched or coached more than 20 startup real estate brokerages. Accurately estimating expenses was one of the most critical steps we took. That’s why I decided to put together this article to outline the right way to estimate expenses for your new brokerage.

Real Estate Brokerage Expense Categories

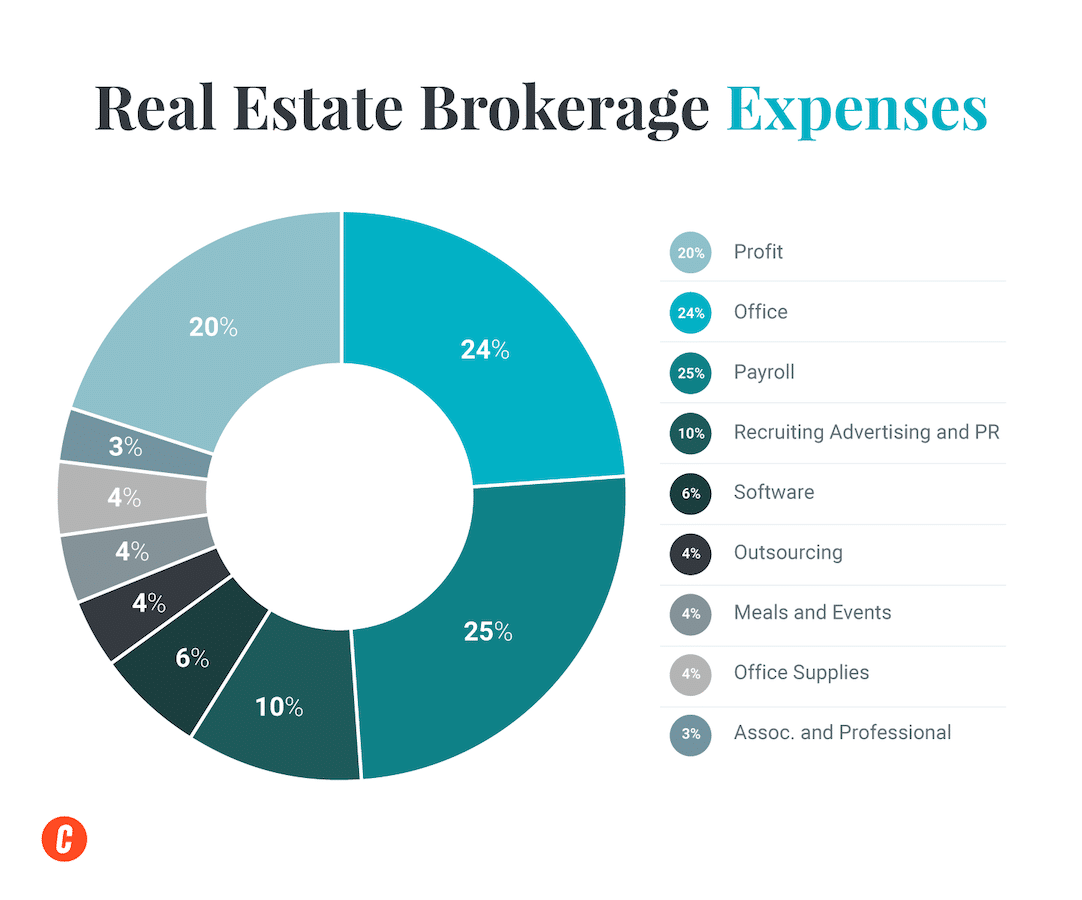

In this article, we’ll review all the common real estate brokerage expenses you may incur operating a new business. Each of the categories below represents a group of expenses along with their estimated annual costs—just divide by 12 to grab your monthly cost. I’ve also pinpointed each category’s ideal percentage of your overall revenue.

I’ll break each category down and explain it in detail. After reviewing each of your brokerage expense categories, you can move to estimating your revenue and completing your real estate brokerage budget.

It’s important to note here that, strictly speaking, profit is not an expense. However, we’ve factored in a 20% profit margin, assuming you want to run a reasonably profitable brokerage business by efficiently managing expenses and revenue according to the guidelines we’ve set forth here. More on this topic later.

Real Estate Brokerage Expense Categories: Costs vs Revenues

Let’s do a quick high-level overview of your expenses. We’ve done a breakout of:

- Categories

- Annual costs

- Percentage of annual revenue

| Expense Category | Estimated Annual Costs | Ideal Percentage of Revenue |

|---|---|---|

| Payroll | $40,000-$120,000 | 25%-30% |

| Office | $80,000-$260,000/year ($0 virtual) | 20%-30% (0% virtual) |

| Software | $13,000-$36,000 | 3%-6% |

| Associations, Insurance & Professional Fees | $12,000-$18,000/year | 2%-4% |

| Outsourcing | $18,000-$24,000 | 15%-20% |

| Lead Gen Advertising | $20,000-$100,000 | (Excluded from operational budget) |

| Recruiting, Advertising & PR | $7,000-$60,000 | 5%-10% |

| Office Supplies | $8,500-$15,000/year | 3%-8% |

| Meals & Events | $9,000-$24,000 | 2%-5% |

| Profit | $120,000-$360,000 | 15%-20% |

Payroll Expenses

Estimated total annual cost: $40,000-$120,000

Ideal percentage of revenue: 25%-30%

Your real estate brokerage payroll expenses may vary. Many new brokers forget to factor in the other expenses from employees—think payroll, paid time off, insurance—and, of course—taxes. A few more considerations when it comes to payroll include:

- The number of employees you have and their statuses (full time, nonexempt, etc.)

- The employment market

- Any additional benefits you choose to offer your employees

Here’s a breakdown on the main payroll expenses you’ll need to account for:

Employee Payroll

Estimated annual cost: $32,000-$96,000

The number of employees you have at any given time depends on the services you’re offering to attract agents and the size of your brokerage. For deeper insight on which employees to hire at different stages of growth, see my previous article: The 5 Employees You Need to Hire to Grow Your Brokerage.

The city and state in which you’re opening your brokerage will also affect the cost of payroll—an office manager’s salary can vary significantly between a city like Chicago and a rural town like Wichita. To get an accurate estimate of hiring costs in your area, you’ll need to research average salaries in the area (make sure to filter by county).

Employee Benefits

Estimated annual cost: $3,200-$9,600

Remember to factor in employee benefits like health insurance, life insurance, vacation days, family leave, 401(k) contributions, and bonuses. These expenses can surprise you later and throw off your profitability if overlooked. Decide now what your policy will be for paid time off and whether or not you will contribute to a retirement plan on behalf of your employees. Keep in mind that these benefits are also great recruiting tactics, which help attract the best talent for your business.

Employer Payroll Tax

Estimated annual cost: $2,700-$8,100

The most common expense new broker-owners overlook is the additional taxes the government requires employers to pay. Let me tell you, the IRS doesn’t take kindly to businesses that fail to pony up. In addition to the hourly wage or salary that you agree to pay your employees, you must also pay employer payroll taxes, which are an additional 7.65% that your brokerage pays to Medicare and Social Security.

Workers Compensation Insurance

Estimated annual cost: $560-$1,680

Most states also require employers to provide workers’ compensation insurance. Failing to do so may result in significant fines or even closure. Workers’ compensation insurance protects the employee and you in the event that your employee gets injured on the job and isn’t able to work.

Payroll Servicing Company

Estimated annual cost: $900-$2,700

If all this gives you a headache, you can hand off all your payroll worries to a payroll servicing company. These companies will handle all the state and national requirements for hiring and managing employees, including legal regulations, tax withholding, and workers’ compensation insurance. Just be sure to factor the additional expense for payroll servicing into your budget.

There’s plenty of broker software options to help you with payroll and accounting, as well as other back-office tasks like compliance management, transactions, and commission management. For example, Lone Wolf Back Office, formerly known as brokerWOLF, has been in the business for more than three decades. The software user interface (UI) leaves a bit to be desired, but it gets the job done.

Office & Office-related Expenses

Estimated total annual cost: $80,00-$260,000 ($0 virtual)

Ideal percentage of revenue: 20%-30% (0% virtual)

Unless your real estate brokerage operates virtually (without an office), your office will likely take up a large chunk of your expenses. Still on the fence about the benefits of a brick-and-mortar versus a virtual office? Consider the type of agents you’re looking to recruit, the services you’ll be providing, and the flexibility of the lease terms. Each situation is different. Since there are so many factors to consider, choosing the right office can be challenging.

For expense purposes, you can break the costs associated with a brick-and-mortar real estate office down into four categories:

- Base rent

- Common area maintenance (CAM)

- Utilities

- General maintenance

Base Rent

Estimated annual cost: $36,000-$66,000

The base rent is the amount your brokerage must pay each month for the use of the space. In a city like Boulder, Colorado, typical office space can range from $25 to $50-plus per square foot. To calculate your base rent on a commercial lease, you’ll need to multiply the total square footage of the portion of the building you are leasing by the cost per square foot.

For example, if you’re looking at office space that is 3,000 square feet and the landlord is asking $22 per square foot for base rent, then your cost would be $66,000 a year in annual base rent. Divide your annual base rent by 12, and you will have your monthly base rent, which in this case would be $5,500.

Common Area Maintenance

Estimated annual cost: $15,000-$30,000

Common area maintenance fees are additional expenses associated with the property that are passed through to the tenant. These tend to include costs directly related to the space you occupy plus the costs associated with the rest of the property, like parking lots or other shared spaces.

Common CAM expenses are cleaning, repairs, building maintenance, utilities, internet, insurance, security, parking lot maintenance, snow removal, landscaping, trash, and taxes.

CAM fees can add $7 to $12 per square foot to your lease, and you can even be charged retroactively if the landlord underestimates the CAM. So, before you sign that lease, make sure you understand your potential liability and what you can afford.

Utilities

Estimated annual cost: $3,000-$13,000

If your lease or CAM doesn’t include utilities, you’ll need to budget for them as well. When you budget for utilities, you may think only of gas, electricity, water, and sewer. However, if you plan to make calls and use the internet, you’ll need to budget for communication costs too. They can add up quickly.

Maintenance

Estimated annual cost: $1,500-$3,000

If everything goes as planned with your brokerage (and why shouldn’t it?), you’ll have lots of wear and tear from busy agents using your office. To keep things ship-shape, you will want to budget for common maintenance tasks. This can include services like trash removal, recycling, and paper shredding.

If you are renting a standalone building or building maintenance isn’t covered in your lease or CAM, then you’ll want to budget for additional building maintenance to ensure your agents and their clients aren’t turned off by a poorly maintained office.

Pro Tip

Don’t forget about the cleaning crew! Your agents won’t stay long if they have to take out the trash.

How to Select the Right Office for Your Real Estate Brokerage

Software Expenses

Estimated annual cost: $13,000-$36,000

Ideal percentage of revenue: 3%-6%

Gone are the days of having four to five employees to run your real estate brokerage. Today many of the services brokerages provide are managed with software, allowing you to run your brokerage with as few as just one employee.

Since there are so many options for brokerage software available today, estimating these expenses can be tricky. For a detailed breakdown of the software choices available to brokerages today, see my article on essential real estate brokerage software tools.

For now, here is a quick look with rough pricing estimates for software you’ll need to consider:

| Software | Purpose | Estimated Annual Cost |

|---|---|---|

| Showing Service | Sets and coordinates showings, manage feedback | $240-$540 per agent or $20 per listing |

| Multiple Listing Service | Managing broker access to your local MLS(s) | $240-$480 |

| Customer Relationship Management | CRM software or all-in-one contact management and lead gen solution | $180 per agent |

| Web Presence | Brokerage website and individual agent websites or pages | $144-$2,400 |

| Digital Marketing Suite | Assists agents or the marketing coordinator in creating and managing agent and listing marketing | $168 per agent or $2,400 per year |

| Transaction Management | Collects and manages required documentation and signatures and keeps transactions on schedule | $85 per agent or $2,400 per year |

| Financial Management | Manages and tracks agent fees and caps, manages brokerage expenses and revenue, and prepares documentation for tax filing | $2,400-$3,600 |

| Paperless Contract Software | Allows brokerage to operate virtually without paper forms | $120 per agent |

| Agent Recruiting Software | Measures and tracks agent performance through the MLS and CRM with proven recruiting templates | $2,400-$3,600 |

| Total Annual Cost | $13,000-$36,000 |

Associations, Professional & Insurance Expenses

Estimated total annual cost: $12,000-$18,000

Ideal percentage of revenue: 2%-4%

Some expenses to run your real estate brokerage are necessary but are far less exciting than renting a flashy office. We’re talking about unavoidable expenses like insurance, banking, and legal costs.

Additionally, expenses like membership dues, licensing fees, and tax preparation can easily be overlooked because they only happen once a year. To create a comprehensive budget, you will need to remember to include each of these annual costs—they can add up, and you don’t want them to catch you by surprise.

Here is a quick breakdown of the expenses associated with licensing, insurance, bookkeeping (assuming you’re not using a payroll service or managing your own books), and other professional costs.

| Category | Item | Estimated Cost |

|---|---|---|

| Licensing | ||

| Brokerage license fees (state) | $550 | |

| Business license (city) | $300 | |

| Use taxes and fees (city) | $150 | |

| Insurance | ||

| Errors and omissions insurance (group policy < 25 agents) | $3,500 | |

| Liability insurance | $400 | |

| Property and casualty insurance | $600 | |

| Memberships | ||

| Realtor associations | $600 | |

| Chamber of commerce | $900 | |

| Legal | ||

| Real estate attorney | $1,200 | |

| Corporate attorney | $300 | |

| Accounting | ||

| Bookkeeper | $600 | |

| Tax preparation | $1,200 | |

| Bank Charges | ||

| Account fees | $300 | |

| Total Annual Costs | $10,600 |

Outsourcing: Transaction Coordination, Compliance Management & Back Office Services

Estimated total annual cost: $18,000-$24,000

Ideal percentage of revenue: 15%-20%

To keep your employee costs low, consider outsourcing as much as you can from the beginning. Fortunately, you can easily outsource brokerage tasks like transaction management and brokerage file review. While you’re at it, consider outsourcing other agent services like photography, marketing, or sign installation and storage.

Transaction coordinator companies charge between $150 and $300 a file, depending on the volume you’ll be sending them. If money is tight, you might consider paying a detail-minded, experienced agent in your brokerage to do it on the side for less. You can also consider integrating your transaction management and commission management into a back-end software like Brokermint or Paperless Pipeline. Check out our guide on the best transaction management software to see if one of those options might work for you.

Lead Gen Advertising

Estimated total annual cost: $20,000-$100,000

Estimated return: $40,000-$400,000

Percentage of revenue: Excluded from operational budget

While providing buyer and seller leads isn’t required to operate a brokerage, many brokerages today pay to generate brokerage referred leads.

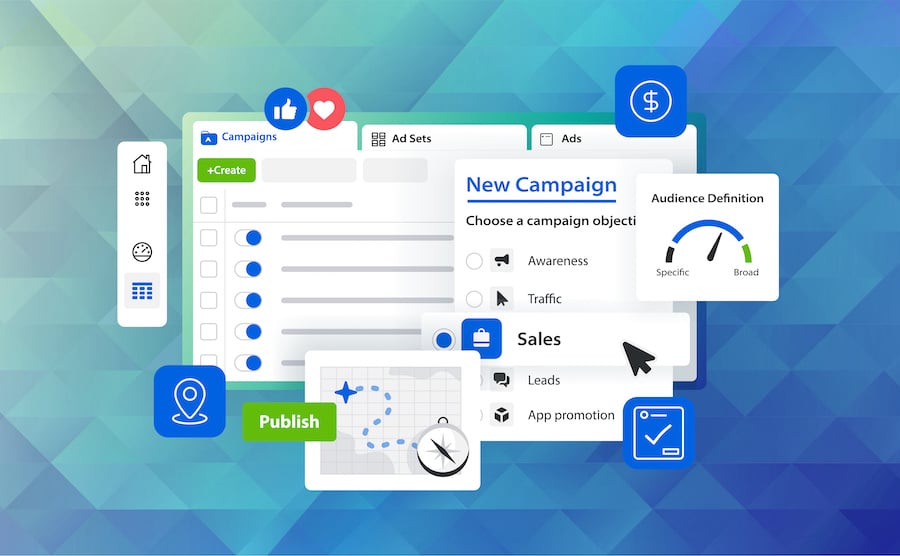

To help manage this, many tech-savvy brokerages use all-in-one customer relationship manager (CRM), website, and lead management software platforms like Real Geeks to generate leads. The cost of these systems ranges from $500 to more than $2,500 per month, excluding advertising costs. The advertising spend necessary to generate a consistent return starts at $1,000 per month and can quickly exceed $10,000 per month. If you’re looking for a more hands-off approach, you can buy leads directly for your agents from services like zBuyer or realtor.com. But keep in mind that you’re spending hard-earned commission dollars to save that time.

To maximize your return on investment (ROI) from leads you buy for your agents, you might want to consider hiring a leads manager to handle the system, track leads, and keep agents accountable. This one hire can increase your ROI up to 400% of the investment you make in lead buying.

Separate Profit & Loss Statement

So why isn’t this in the operational budget? Instead of including the cost of the system, advertising, and leads manager in your brokerage’s overall budget, I recommend having a separate profit and loss (P&L) statement for the leads program. This P&L will combine the expenses of running the program with the revenue received as referral fees. Your agents will pay a portion of their commission or referral fee at the close of any transaction referred from the leads program. This P&L will quickly show you if the program is operating profitably.

Recruiting, Advertising & PR Costs

Estimated total annual cost: $7,000-$60,000

Ideal percentage of revenue: 5%-10%

Recruiting, advertising, and PR expenses will also take a significant chunk of your revenue each month. Here are some quick estimates of common costs associated with recruiting, advertising, and PR.

Agent Recruiting Ads

Estimated annual cost: $3,000-$6,000

Even if you do no other advertising, you’ll want to budget for agent recruitment ads on websites like Indeed, ZipRecruiter, and LinkedIn if you wish to grow your brokerage rapidly. These websites charge a monthly fee to run recruiting ads.

Newspaper Display Ads & Press Releases

Estimated annual cost: $0-$24,000

Yes—the newspaper is still an effective way to promote your brokerage and your listings. This is especially true in high-traffic tourist destinations, small towns, and areas where the average population is older. To save money, negotiate your display ads in six- to 12-month agreements instead of weekly ads.

When your agents feel appreciated, they will stay. The best way to welcome a new agent aboard or celebrate an agent’s accomplishments is to do paid press releases. Most newspapers will run these for a few hundred dollars. Take my word for it—it’s totally worth it!

Signs, Swag & Business Cards

Estimated annual cost: $1,000-$8,000

Printing, storing, and managing your brokerage’s listing and open house signs will not only make your agents happier, it will help you maintain your brand image and standards. Contract with a sign company for a volume discount.

Physical swag like custom pens, coffee mugs, shirts, hats, or umbrellas can also go a long way to helping you promote your brand and make your agents feel part of a team.

Another outstanding way to maintain your brand while standing out from the brokerages that make agents pay for everything is to provide business cards for your agents. It is a low-cost and simple gesture that agents will cherish. Check out our breakdown on the best real estate business cards (plus mistakes to avoid).

Social Media & Google Remarketing

Estimated annual cost: $3,000-$22,000

Build your brand awareness by having a solid remarketing campaign on both Google and Facebook. This displays your brokerage ads to visitors who landed on your website when they later use Google or Facebook. It will not only build your brokerage brand with the community, but with new potential agents as well.

Also, don’t miss the opportunity to set up your Google Business Profile and Yelp for Business accounts. Both of these will help consumers find your brokerage quickly.

Office Supplies & Other Expenses

Estimated total annual cost: $8,500-$15,000

Ideal percentage of revenue: 3%-8%

The expenses related to office supplies have decreased dramatically this year, but they can still be significant. Yet, if you are building a full-service brokerage, you still want to be prepared to support the busy agent who needs their marketing and presentations professionally printed and bound.

You will also have some costs related to your part-time and full-time employees working at the office each day.

Coffee & Filtered Water

Estimated annual cost: $1,500

Truth be told, I love coffee, and I am a coffee snob. Brokerages that don’t provide their employees and agents quality coffee and filtered water may as well be saying, “We actually don’t want you here!”

Do yourself and your team a favor and spend a little extra on the small things that matter. Coffee and water service companies like Lavazza will keep you stocked up and prevent you from having to run to the store for coffee five minutes before the team meeting.

Office Supplies & Paper

Estimated annual cost: $1,200

The cost of pens, paper, and Post-it notes adds up, and if not managed, these can quickly eat up your profits. To keep office spending under control, set a monthly budget so everyone knows where the spending limit lies.

Copy Machine & Ink

Estimated annual cost: $3,600

You may find this shocking, but a top-of-the-line copy machine today can cost as much as a used car! Copy machine companies will do their best to tie you into a long-term lease on a new machine for $500 to $700 a month.

They will tell you that you will save money over time. What they don’t tell you is that the lease cost usually doesn’t cover the total cost of the ink. They will say things like, “Ink is only 3 cents a page.” What they don’t say is that a color page uses four ink colors per page. In reality, each color page costs 12 cents a page, and this is in addition to the cost of leasing the copier.

To keep your budget within reason, I suggest you find a used copier for $3,000 to $5,000 and then pay for a maintenance contract for $200 to $300 a month, including ink for a limited number of copies.

Shredding

Estimated annual cost: $480

With identity theft at an all-time high, shredding confidential printed documentation is a must. You can even turn this into an event at your brokerage for agents to invite their clients and generate business.

Meals & Event Expenses

Estimated total annual cost: $9,000-$24,000

Ideal percentage of revenue: 2%-5%

Unless you want to be personally footing the bill each time you meet a potential recruit or have a team meeting (guilty!), you will need to include meals and events in your expenses. Here is a quick breakdown of estimated expenses for meals and events for a small brokerage:

| Event | Frequency | Estimated Cost |

|---|---|---|

| Recruiting & Retention (coffee & lunches with recruits or agents) | Twice a week | $20-$50 each |

| Team Meetings | Weekly | $75-$150 each (consider getting sponsors) |

| Training Events: (CE, software training, contract classes, etc.) | Monthly | $150-$250 each (consider getting sponsors) |

| Large Events: (award ceremonies, brokerage open houses, client appreciation parties) | Quarterly | $1,000-$4,000 each Includes: event space, speaker, coffee, and snacks (consider getting sponsors) |

| Holiday Party | Annually | $2,500-$7,000 Includes: event space, catering, entertainment, and drinks |

| Total Annual Cost | $9,000-$24,000 (assuming 50% sponsorship) |

Pro Tip

Find a sponsor for your events! Title reps love to schmooze and you can provide a free lunch for your event. Most states allow mortgage and title companies to pay a small portion depending on the number of agents in the room, or they may allow them to pay for a booth or an opportunity to speak to your group.

Profit as an Expense

Most people don’t think of profit as an expense. But if you wish to build an accurate budget for your real estate brokerage, you will need to factor in the profit you want to make.

Let’s use a comparison of selling apples at your local farmer’s market. Say the cost of buying the apples from a local organic grower costs you $5, and then you spend $2 on cleaning them and placing them in a bushel. Your cost of goods is $7, right? However, you also have other expenses like gas and the rent on your space at the farmers market to consider. These two expenses run you an additional $60 a month.

So what’s your profit? Well, your profit will depend on how many bushels of apples you sell. To determine how many apples you need to sell each month, you must first determine how much profit you wish to make.

Let’s say your goal is to make $300 a month in profit selling apples at the market. Knowing that the cost of goods is $7 a bushel and your monthly expenses are $60 a month, we can now calculate that you must sell 120 bushels each month to make $300 in profit.

Creating a budget for your real estate brokerage is no different. Decide on an amount or percentage of profit you wish to achieve each year and add it to your expenses before estimating your revenue.

Further Reading & Next Steps for Aspiring Broker-owners

Now you’re ready to estimate your expenses. Once you complete that, you can move to the fun part: estimating your real estate brokerage revenues and finalizing your budget. Don’t forget to grab your free real estate brokerage budget worksheet.

If you are building or considering starting your real estate brokerage, check out our growing list of industry insider articles on starting, running, and growing your brokerage. And if you’ve got some budgeting tips that we haven’t covered, let us know in the comment section.