When it comes to real estate investing, we are exposed to outstanding opportunities all the time. Sadly, we often don’t have the cash or real estate clients to take advantage of them. They turn into “the deals that got away.” The key to jumping on the right opportunities for yourself or your clients is knowing what they are and how to spot them.

If you can identify investment opportunities for yourself, you can find them for your clients as well. In this article, I’ll share three types of real estate investment opportunities that may help you and your clients build generational wealth.

1. Fix & Flip Real Estate Investing

In case you have been living in a cave without HGTV, fix-and-flip investing is buying a property, remodeling it, and quickly reselling it—hopefully for a hefty profit!

Most real estate agents stay clear of flipping homes, choosing instead to focus on helping buyers and sellers. However, due to the aging and outdated housing inventory and the inability for new construction to keep pace with growth, I predict flipping homes will soon become a common source of business for both real estate agents and brokerages.

To remain competitive, they’ll purchase outdated homes and update the mechanicals and fixtures to appeal to the demands of buyers who don’t want to deal with costly repairs. This shift will make flipping homes more than just a side business and the domain of just a few agents and investors.

When you learn how to find and analyze “fix-and-flip” investments, you’ll know how to generate a little extra money for yourself or your handy investors.

How to Spot Fix & Flip Opportunities

As real estate agents, we’re on the front lines when it comes to dealing with homeowners’ financial problems. Personal challenges like bankruptcy, divorce, death, and job loss can force homeowners to sell quickly. Many of these properties are in poor condition, making them ideal for a quick flip.

Companies like Zillow, Offerpad, and Opendoor have already figured this out. Their model of purchasing such homes has proven that there are a significant number of desperate sellers who don’t have the time or resources to sell their homes the traditional way. Such sellers are often willing to sell at a deep discount for the convenience of selling their homes quickly, in AS-IS condition.

Today, the public data from preforeclosures, bankruptcies, divorce, and death are easily accessible. Armed with the right systems and scripts, you’ll be able to find deals that are ripe for flipping. If you want to learn more about finding motivated sellers, we offer a course available with every Close Pro membership.

If you want an easy to use, accurate, and up-to-date source of distressed properties like preforeclosures to pitch, foreclosure.com is a good place to start looking for investment leads.

To be clear, I am not a proponent of taking advantage of people in difficult situations. However, maintaining a list of real estate investors (including yourself) who are ready, willing, and able to purchase properties in as-is condition quickly is a service you can provide to help distressed homeowners. After all, they need to sell quickly, and you can help them do just that!

Fix & Flip 101: 10 Steps to Flipping Houses (the Right Way)

2. Cash Flow Real Estate Investing

Cash flow investing is investing in properties where the rental income is greater than the costs associated with the property. Paying off the mortgage with rental income instead of appreciation is the primary goal of cash flow investing.

While appreciation is an additional benefit of cash flow investing, it’s usually not factored into the analysis or purchasing decision. The long-term goal of cash flow investing is to eventually have a paid-off property that will forever generate passive income.

Think about cash flow investing this way: What if you owned an asset that someone else paid for, and it paid you thousands of dollars each month—BUT—you could never sell it? Would you be OK with that? Of course you would! So would your clients!

Appreciation isn’t a factor with cash flow investments because the goal is never to sell them.

How to Identify Cash Flow Real Estate Investing Opportunities

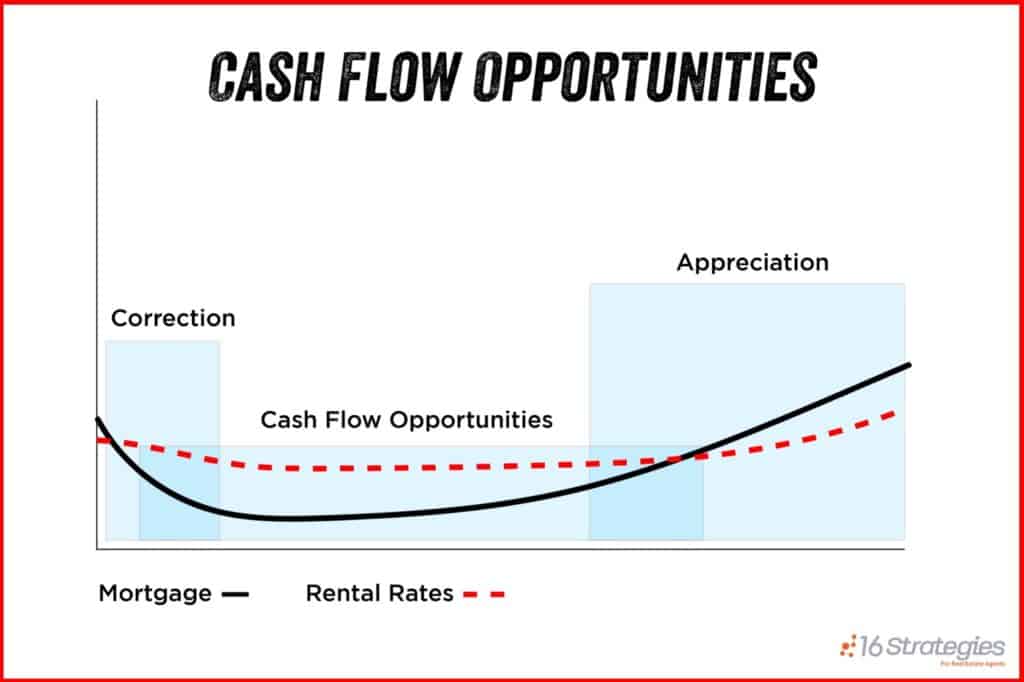

Everyone knows that real estate markets fluctuate over time. What goes up must come down. Those market downturns are where the cash flow investing opportunities lie.

The challenge is having the guts to jump in and buy when everyone else is running scared. Famed investor Warren Buffet once said, “Be fearful when others are greedy, and greedy when others are fearful.” If you’re working with buyers, part of your job is to help them understand this basic principle of investing in real estate.

The other challenge with investing long term in real estate during a down market is having access to financing. During recessionary periods, banks and investors become hesitant to invest. Loans are harder to secure. Banks and lenders often raise requirements, down payments, and interest rates for borrowers to protect themselves from risk.

As a result, you and your potential investors must prepare in advance for any market downturns. Have additional cash reserves and your financing in place so you can buy cash flow properties before the market rebounds.

How to Analyze Cash Flow Real Estate Investments + Attract Investor Clients

If your market is too hot for cash flow investing, then maybe you should consider the third type of investing every agent needs to know about: speculation.

3. Principled Real Estate Speculation Investing

Speculation investing means buying a property with the hope that future market conditions will allow you to sell the property for a profit. Speculation differs from fix-and-flip investing because there is no need to make changes or repairs to the property.

Real estate speculation is much more than just a lucky guess. A professional speculator considers things like employment, population growth, and housing inventory before investing. You need to pinpoint opportunities where demand for the property is likely to increase over time, allowing you to buy low and sell high so that you can cash in on a hefty return down the road.

How Smart Investors Decipher & Respond to Real Estate Market Cycles

How to Find Speculation Opportunities

If you or your investors are ready to take calculated risks in real estate speculation, then your best bet is preconstruction homes. I’m not saying you should become a home builder. Instead, you can contract with a builder for the opportunity to purchase a home that has not yet been built. Many builders will agree to construct a home for a small deposit and allow you to buy the property after it is completed.

There are two benefits to this strategy: First, everybody likes new construction homes, and second, you’ll be able to lock in today’s price while someone else assumes the risks of building the home.

Some homebuilders can take six to 12 months to complete a home. High-rise condos can take years. If appreciation in your market is strong, you or your investors can potentially build tens of thousands in appreciation while risking only a small deposit before you ever own the property.

Once the property is near completion, do your final research to determine the current market value before finalizing the purchase. If it has appreciated, complete the sale and rent or resell the home. If the value isn’t there, try renegotiating or cutting your losses, surrendering your deposit, and walking away.

Beware of the Speculative Bubble

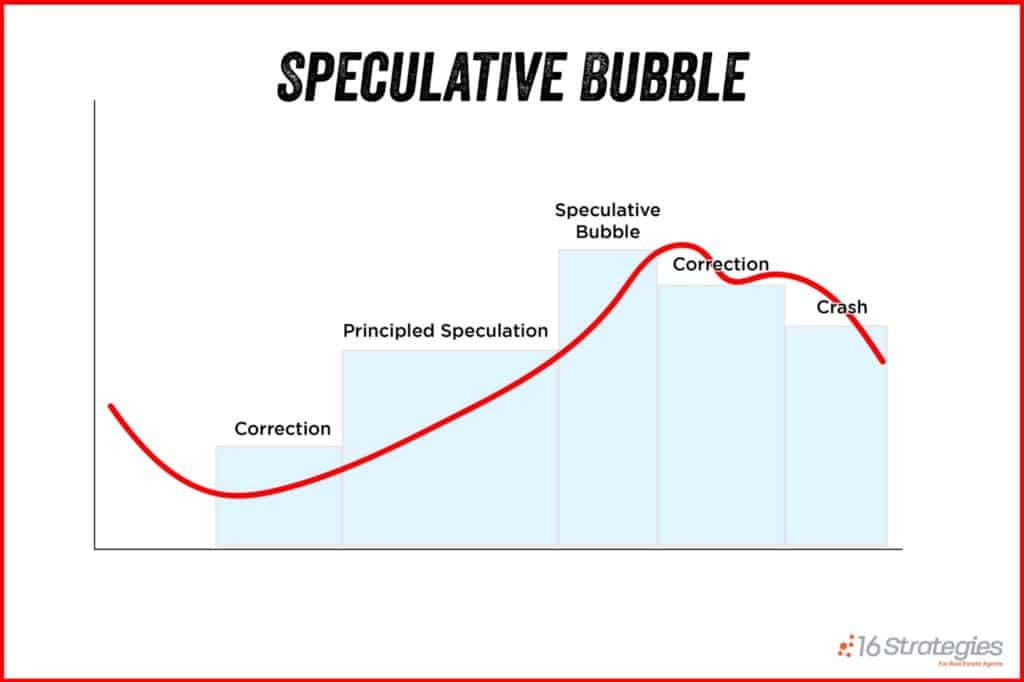

Speculation is the riskiest of all types of investing. Rapidly appreciating markets fuel greed and can convince you to jump in without relying on principled fundamentals. When too many people follow suit, it causes a speculative bubble.

The speculative bubble occurs when exuberance and justification trump logic, creating an unsustainable market. As more people jump in, they further fuel appreciation. The bubble expands until the fundamentals suddenly catch up and the market sharply corrects itself, and the bubble “pops.”

When this happens, it can leave you and your investors owning properties on which you may have to take a loss or else hold for years until the market rebounds. Despite the risks, you and your investor clients should engage in principled real estate speculation, as it’s an essential part of real estate investing.

Bottom Line

Being knowledgeable about real estate investing and participating in real estate investment are essential skills for every successful real estate agent. The more investing you do on your own, the more capable and confident you’ll become in helping your clients with their real estate investment decisions. These three strategies—fix and flip, cash flow investing, and speculation—should be the pillars of your investment career.

Add comment