In the competitive real estate landscape, you need to know how to make your offer stand out from competing offers so you can get more buyers into their dream homes and close more sales. In a multi-offer market, it’s thrilling when your clients, whom you’ve grown to know and love, submit an offer and WIN! I’ll cover eight strategies you can implement immediately to get more accepted offers for your buyers.

Key Takeaways on How to Make an Offer on a House:

- Tell the listing agent your buyers won’t nitpick the home inspection—they want to know what repairs to budget for.

- If the sellers need more time to vacate, see if the buyers are willing to extend the seller’s stay post-closing.

- When a listing agent wants to wait until after the open house to submit offers, submit your all-cash offer above the asking price with minimal contingencies. Do this before the open house with a 24-hour offer expiration deadline to nudge an acceptance. If the offer expires, the buyers can always resubmit during the open house.

1. Follow the Basics of an Offer Letter

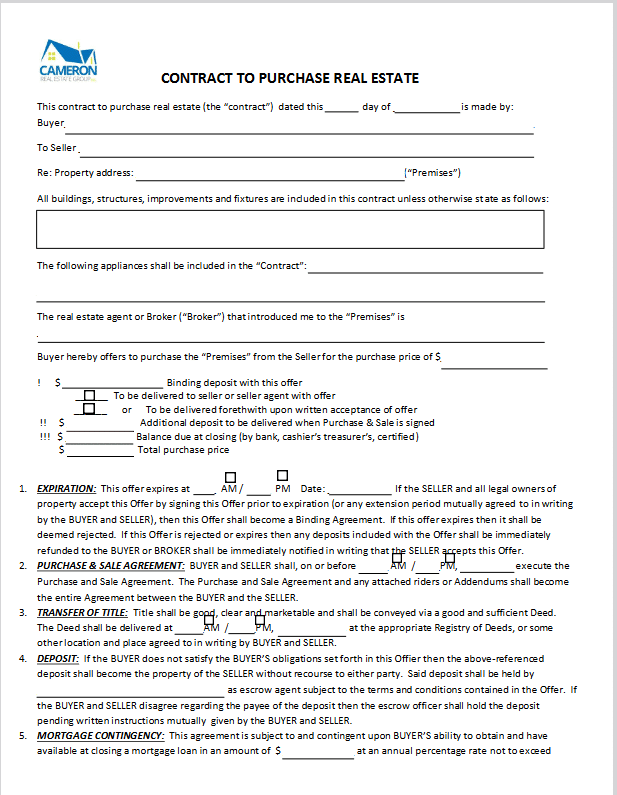

Educating your clients on how offers work in your state before they submit one is good. For example, in some states, like New Hampshire, you write the offer directly into the Purchase & Sale Agreement (P&S). In Massachusetts, agents use a separate offer form. Once your offer is negotiated and accepted, you complete the P&S.

You should also inform your buyers of the rules regarding verbal offers in your state since these could be legally binding. You must diligently get the offer in writing before submitting it, though, and include everything the buyers ask for so there’s no confusion. You can convey the offer details over the phone to the listing agent but do so immediately after sending the official offer attached to the offer letter email. Things that should definitely be included in an offer letter are:

- Purchase price

- Deposit/earnest money/down payment

- Outline of contingencies (finance/mortgage, inspection, appraisal, etc.)

- Inspection date

- Closing date

Offer Letter & Template

The offer letter email you send to the listing agent must be clear and summarize the full offer details, even if you’ve attached the formal offer. This step is critical because if you only provide partial information, something could get lost in translation. Turn on “read receipts” to ensure that the listing agent has seen and read your email and offer.

You can copy and paste this sample offer letter into your email:

Dear {Listing Agent’s Name},

I hope this email finds you well. I’m excited to submit an offer for your listing at {Property Address}. After reviewing the property and discussing this home with my client(s), we are pleased to present the following offer terms:

- Offer Price: ${Offer Price}

- Deposit: ${Amount}.

- Inspection Date: To be completed by {Date}, with objections (if any) proposed by {Date}. (If you are limiting your inspection to appliances and systems, let them know.)

- Closing Date: We aim for a quick and easy {Number of days}-day closing, with a proposed closing date of {Date}.

- Additional Terms: (Any other relevant terms or conditions, such as financing, addendums, contingent on sale of other home, etc.)

These terms reflect a fair and compelling offer for the property. My client(s) [is/are] prepared to proceed quickly to formalize this offer and start the process.

I eagerly await your prompt response and, of course, am available to discuss any aspects of this offer or answer any questions you or the seller(s) may have.

I look forward to working with you.

Warm regards,

{Your Name}

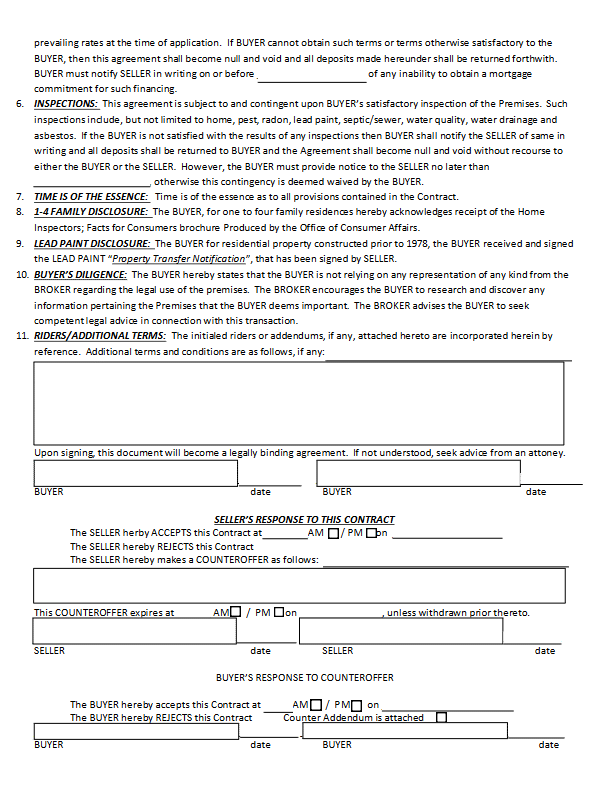

A word of caution: If your buyer is getting a loan, and there are furnishings or other detached personal items belonging to the seller they wish to ask for in their formal offer, it’s essential to know the lender’s rules. Mortgage underwriting ignores attached items like drapes and chandeliers but not detached things like furniture or a farm tractor. It’s better to add these requests to an addendum and follow lender disclosure rules for personal property so it doesn’t slow the process.

2. Use Contingencies Wisely

When learning how to make your offer stand out in a tight seller’s market, the fewer contingencies, the better. Buyers have less negotiating power, so to help them make their offer stand out, encourage them to consider how they intend to use contingencies such as inspections, financing, closing dates, appraisals, and their down payment.

Consider using a few of them wisely to make your offer stand out.

Home Inspection Contingency

Over the past few years, waiving the inspection became the norm, but when representing a buyer, have their best interests at heart. We might think getting the home at any cost is in their best interest. After all, they’re so excited, and we want to make their dreams come true. However, there are more imaginative ways to go about this. Ultimately, it is their call to waive the home inspection. Our job is to give them all the information they need to make an informed decision and help them weigh the pros and cons of their choices.

Here are some things to consider with home inspection contingencies:

- Buyers choosing an inspection can strengthen their offer by stating they won’t nitpick it. The buyers just want to budget how much additional money they will need to put into the home. Saying they won’t nitpick tells the sellers they’re reasonable.

- Have buyers attend the home inspection and talk with the inspector about any major repairs. Getting information during the inspection will save time waiting for the written report.

- They still have an “out” if repairs are beyond their budget or if there is significant structural damage.

- Not nitpicking leaves the door open to renegotiate with the sellers if big repairs are needed.

Take note: If other buyers are willing to waive inspections, the sellers could decline your offer, but it may save your buyers from significant costly repairs. The sellers may refuse the repairs, but your buyers won’t be locked into a lemon of a home!

Financing Contingency

If the buyers can offer all cash, that’s ideal, but not everyone can. In this case, ensure they have an updated pre-approval letter from their lender with an amount at or exceeding the asking price.

Here are some tips for softening a financing contingency:

- Encourage buyers to get a checklist from the lender beforehand of everything needed to move it through underwriting quickly. Start gathering, organizing, and submitting everything the lender requires.

- Ensure underwriting swiftly receives what they need about the property once the offer is accepted.

- Get appraisals and inspections scheduled as soon as the offer is accepted so there are no delays.

- Check in regularly with the lender to ensure everything runs smoothly. The more prepared your buyers are, the faster things move through the underwriting process.

Earnest Money Deposit & Down Payment

An earnest money deposit is an initial upfront payment buyers make to show “good faith” to the seller that they’re serious about the property. While there are no rules on how much cash to pony up, to make your offer more solid, have them put down a larger sum than the 1% to 3% of the offer price that most agents suggest. In potential multiple-offer situations, a sizable earnest money deposit can show your buyer’s commitment to the home and the seller.

This amount should be considerable enough to catch the seller’s attention. Also, tell your buyers this deposit is part of their loan down payment and deducted from their costs. The down payment is the percentage of the loan-to-value the buyers pay. Some examples are a 20% down payment on a conventional mortgage with no private mortgage insurance (PMI) or 3.5% on an FHA loan. Offers from buyers with more “skin in the game” via a large down payment are more compelling than small down payments. They give the impression of greater financial stability.

Pro tip: If your buyers are serious about the home and you want to strengthen their offer and make it stand out, consider making the earnest money “hard” after a specific date or contingency deadline, meaning the sellers get to keep the deposit for any reason the deal falls apart after the set date.

Appraisal Waivers

Sometimes, a lender will offer a waiver if a property recently had an appraisal or the buyers put down a significant sum of cash, lowering the loan-to-value ratio (LTV). A considerable deposit reduces the lender’s risk. Waiving an appraisal can save the buyers money and shorten the transaction period by several weeks.

Even though there are strict guidelines on appraisal waiver qualifications, having one in your offer can give the seller the illusion of less hassle. Appraisal waivers are challenging, so have your buyers talk to the lender before looking at homes to see if that particular lender has done them or would consider them and under what circumstances. Sometimes, loans underwritten by Fannie Mae will allow an appraisal waiver (aka “value acceptance”). The Federal Housing Finance Agency (FHFA) offers appraisal waivers to low-income families for properties in rural areas with at least 3% down with a mandatory home inspection.

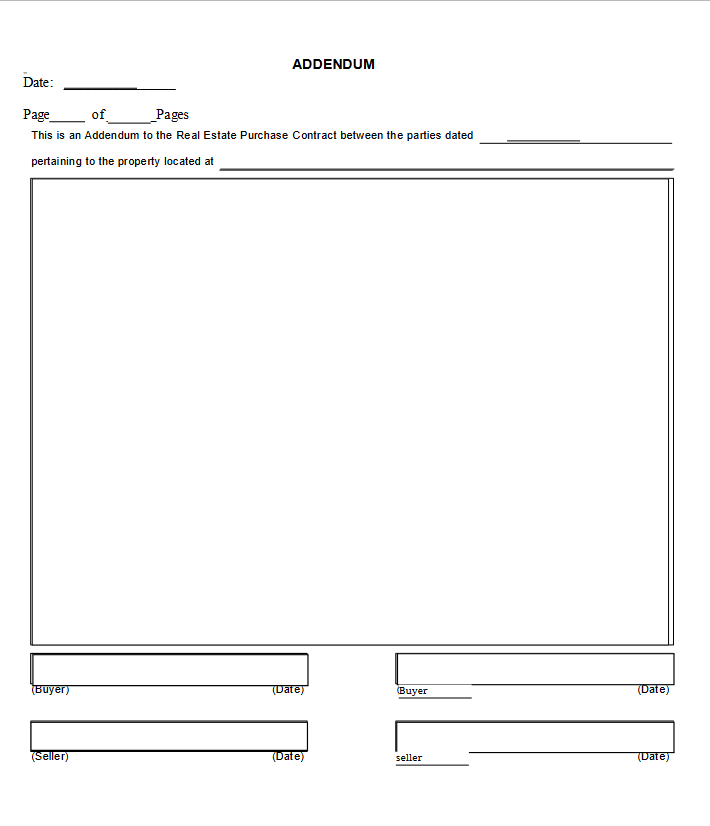

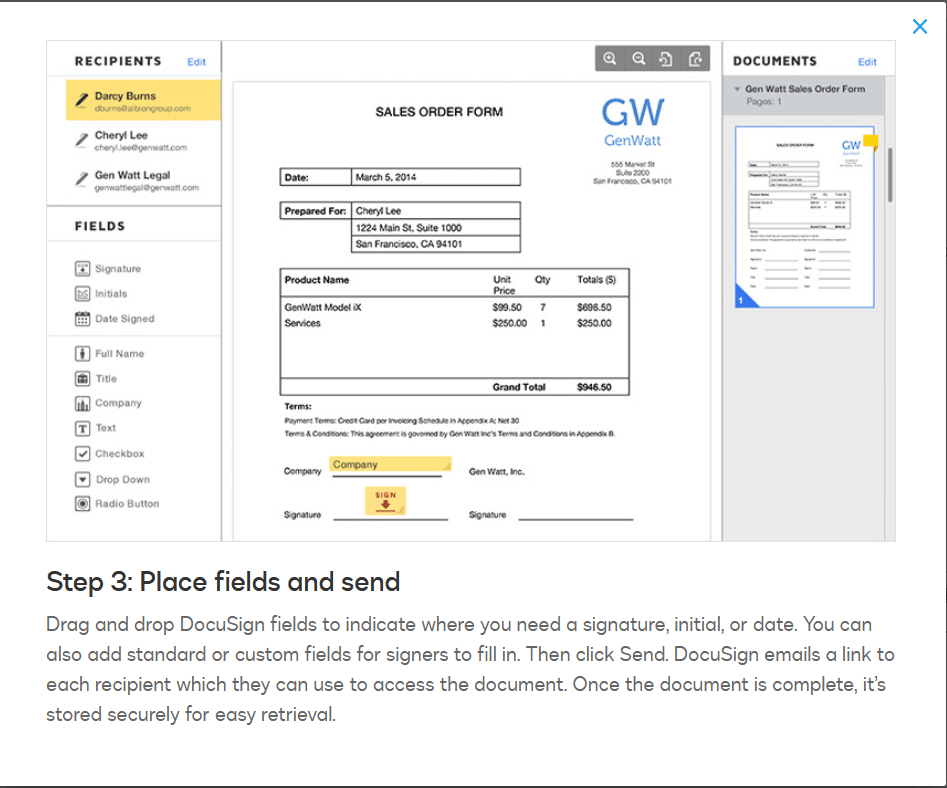

Need to get your offer signed fast? Check out DocuSign, where you can upload documents and create signature form fields for agents, buyers, and sellers to sign. With an affordable monthly subscription, the platform provides necessary real estate forms with built-in data fields and auto-fill features to quickly create and send your documents. It offers a 30-day free trial with no credit card sign-up required, so you have nothing to lose when checking this industry leader out.

3. Tweak Home Sale & Home Purchase Clauses to Your Benefit

Buyers who own a home often need to sell before closing on the next house. Carrying two mortgages may put them above their debt-to-income ratio (DTI), and they may need proceeds from their existing home to afford their new digs. Sellers also may need time to find a house after their home goes under agreement. You’ll need a little finesse to make your offer stand out in these cases.

Home Sale

It’s ideal if your buyers could close without selling a home first, but not everyone can do this. See if they can sell their home and rent until they find a home. You could also add a clause that they’ll proceed with the purchase if they don’t sell their home by a specific date. Ensure they can follow through if their deal falls through on their primary residence.

You can also ask them if it is OK to share the P&S on their current home and their buyer’s loan commitment letter to assure the sellers that they have a solid buyer and can close quickly. They can also do a kick-out clause where the sellers can continue to show and entertain offers. If they get an offer during the kick-out period, they can accept it and kick out your buyers. While not ideal, it may be enough for a seller to take a home sale contingency.

Home Purchase

Sometimes, the sellers need time to buy a home with the proceeds from the sale of their home. You can sweeten your buyer’s offer by adding a contingency that the sellers can remain in the house after closing for an agreed-upon period, usually up to a month. Some buyers offer to charge them a reduced rent during this transition period, but if it can help your offer stand out, they may waive this and let them stay gratis.

4. Utilize Dates & Deadlines to Optimize the Offer

Use dates and deadlines strategically to smash the competition and make your offer letter stand out. A flexible closing date will outshine a fixed one, even if the sellers can’t close quickly. Why? It shows them that no obstacles on the buyers’ end prevent the sellers from moving forward with their plans. Think about it: If you have two offers, one can close on the seller’s timeline, but the other needs 60 days to sell their home and get financing, which is more appealing? Both buyers may have a house to sell and a financing contingency, but all things being equal, the flexible buyer stands out.

Here’s a hack I tried once that landed my buyers their dream home: When multiple competing offers are present, have the buyers submit a shorter offer acceptance deadline. I’ve had buyers submit a cash offer above asking with no contingencies when the listing agent said they were holding all offers until after the open house. We set a 24-hour offer expiration that ended the same day as the open house. We won the deal, and the agent canceled the open house. Score!

One caveat: Be mindful of how you use this because it can backfire if the seller tries to do better at the open house. However, it can prevent the listing agent from leveraging your buyer’s offer against competing offers and creating a bidding war. Your buyers always have the option to submit another offer through you during the open house if their deadline passes.

5. Understand the Market & Use It to Your Advantage

As an agent, you must coach your buyers through the homebuying process and ensure they understand the current market. This knowledge is critical for making your offer stand out. If the buyers know we’re in a low-inventory, tight seller’s market, they’re less likely to give a lowball offer loaded with contingencies. In a buyer’s market, you can help your clients score a great deal and possibly some seller concessions and repairs.

Show your buyers a few things to help them understand the type of market and the competition for homes. There are a lot of metrics used in real estate to understand the market, but you don’t need to overwhelm the buyers with a bunch of data. A few can serve you well to reach your goal of making your offer stand out. These include:

- Housing inventory: Reduced inventory can be an eye-opener for buyers who want to submit a low offer. In low-inventory markets, it could be a while before another house meets their wants and needs, so they must immediately submit their highest and best offer.

- Days on the market: In a seller’s market, he who hesitates is lost. If properties fly off the market, there’s no room to hesitate. Buyers have greater leverage in their offers if the homes sit unsold.

- Listing vs selling price: If area homes sell above the asking price, you want to show buyers the properties where they can compete. To make them ultra-competitive, find homes listed below their maximum loan amount, giving them more pricing leverage.

- Assess the competition: If they are competing in a market flooded with all-cash buyers, consider what they can include in their offer to make them a solid contender. For example, fewer contingencies or a faster closing can help buyers who need a mortgage.

- Number of offers before getting accepted: Showing your clients how many offers buyers make before getting an accepted offer can lessen their anxiety and keep them from giving up. You can learn this info by talking to other agents and evaluating how many offers your clients have lost out on before accepting one.

6. Evaluate Your Client Needs & Budget

Before traipsing buyers from home to home, have them come into your office to discuss their needs versus wants in their new home and evaluate their budget and financing approval limits. This process is a standard but critical practice if you want your offer to stand out. If the buyers have champagne taste on a beer budget, you don’t want to show them properties they can’t afford. You have to evaluate their needs and their budget.

If they have a long list of “must-haves,” it will limit what they can buy. You must sort this out so you’re not wasting time on showings and writing up offers on homes that buyers will back out on if they don’t have everything they expect. As an agent, you must get to know your buyers and help them think logically and realistically. There will be no HGTV Dream Home here if it’s not in their reach.

7. Follow Up Promptly & Often

If they love the house, get them to pull the trigger after looking at it. Don’t let your clients sit around and mull over an offer. Make sure you submit it and call the listing agent (or the sellers immediately if you’re on both sides of the transaction in a dual agency situation). Follow up with the listing agent within 24 hours and just say you’re checking in if there’s any news. Keep your clients updated with any new details.

8. Skip the Real Estate Love Letter

Yes, you read that right. Many agents encourage homebuyer letters to the seller when teaching them how to make an offer on a house that stands out, but it puts you and the sellers at risk of Fair Housing violations and discrimination. Instead, when you call the listing agent, gush over how much they loved the home and keep the focus solely on what they love and their fantastic offer.

Don’t give personal details about anything in a protected class. Also, highlight how the buyers are sweetening the deal, such as waiving contingencies, putting more than 20% down, paying all cash, having a quick closing, or giving the sellers time to find a new home.

Your Take on How to Make Offers Stand Out

We’ve been in a low-inventory seller’s market for the last several years, so you need to get creative to make your offers stand out. Use contingencies, dates, and clauses to your advantage, and follow up with the listing agent and lender frequently. Do you have any tips and tricks you’ve used to make your offers stand out from your competitors? Share them in the comments.