In my 27-year real estate career, I have completed countless fix-and-flip projects and helped hundreds of investors find, evaluate, and sell properties for big profits. Through hard-won experience, I came up with a proven process that anyone can use to assess fix-and-flip opportunities.

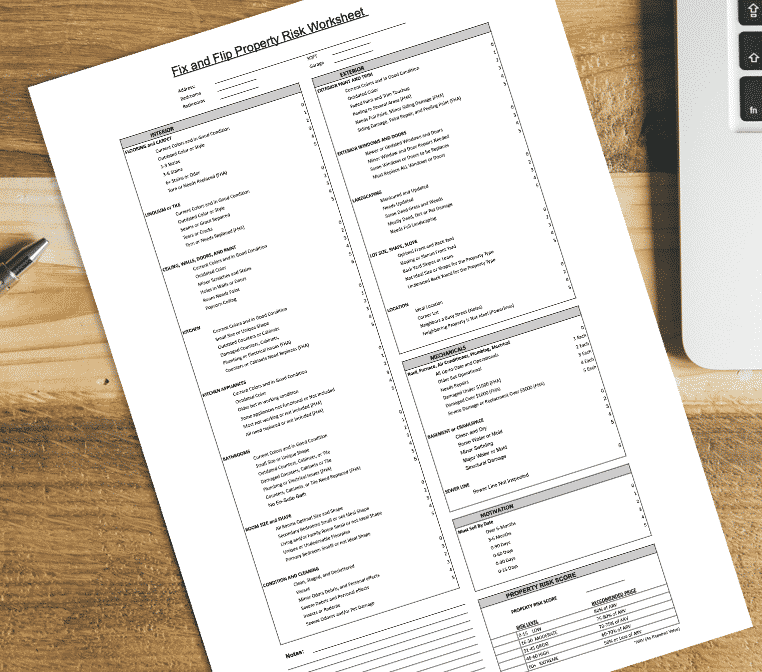

In this article, I will walk you through my Property Evaluation Process that I use to evaluate my fix-and-flip projects and determine the right offer price using my Fix-and-Flip Property Risk Worksheet. Make a copy of the worksheet, then read on to learn how to thoroughly evaluate your next fix-and-flip project.

Tools You’ll Need to Properly Evaluate a Fix & Flip

Be prepared to get dirty when you’re evaluating your fix and flip. Bring some old clothes or coveralls so you can get into the crawlspace and attic. Don’t forget some water on hot days because this could take an hour or two. Here are some essential and handy tools I suggest you bring when evaluating a fix and flip:

Be prepared to get dirty when you’re evaluating your fix and flip. Bring some old clothes or coveralls so you can get into the crawlspace and attic. Don’t forget some water on hot days because this could take an hour or two. Here are some essential and handy tools I suggest you bring when evaluating a fix and flip:

- Your cell phone and charger to take videos and photos

- A ladder to look on the roof (I don’t suggest getting onto the roof)

- A measuring tape to measure the rooms, cabinets, and yard

- An outlet meter to check the outlets and ground fault circuit interrupter (GFCI) circuits

- A moisture meter

- A flashlight and extra batteries

- An awl or sharp screwdriver to poke into wood trim, baseboards, and subfloors to check for rotting wood and moisture damage

- A large level and some marbles to check the floors and counters to see if they are plumb

- For older properties, test for lead paint with low-cost, lead-based paint test kits

My Fix & Flip Property Evaluation Process

I developed my Property Evaluation Process to ensure that no part of the property would be overlooked. Using the Fix-and-Flip Property Risk Worksheet, you will start with the interior and work your way throughout the house. Then, once you finish assessing the interior, you’ll move on to the exterior.

For detailed instructions on how to use my risk worksheet, refer to our recent article Fix & Flip Risk Assessment: How to Make the Right Offer. As you evaluate the property room by room, you will rank the condition of each area or item on the worksheet based on the cost or amount of work the area or item will need.

1. Evaluating a Home’s Interior

The Living Room

Start with the interior. Walk into the living room and take a long slow sniff: Do you smell any odors from pets, mildew, mold, or smoke? Believe it or not, strong odors can be costly to fix.

Take a look at the floors. Are there stains or tears in the carpets? Will they need to be replaced, or can you recondition them? Are the floors level, sagging, or soft? Each of these issues can be a sign of water or structural damage.

How are the walls? Are they damaged or need painting? Check the ceiling; is it a popcorn texture? Could it be asbestos?

Mark all the potential risks on your Fix-and-Flip Property Risk Worksheet.

The Kitchen

Walk into the kitchen. Are there tears, stains, or cracks in the tile or linoleum? Do the floors need to be replaced?

Check under the cabinets. Is there visible water damage? Can the cabinets and countertops be salvaged, or is it time to upgrade them? How about the kitchen appliances? Are they off-color or at the end of their lifespan?

Use the outlet meter to check the outlets to see if they are working and on a GFCI. This is a crucial step because you may be required to add GFCI outlets when you remodel.

Plan on spending most of your budget in the kitchen. It is the most expensive room in a house to remodel. A good appliance package alone can run upward of $4,000, and cabinets and countertops can cost an additional $10,000 to $20,000. But if done right, the kitchen can also give you the most return for your buck.

List the needed repairs on your Fix-and-Flip Property Risk Worksheet and move to the bathrooms.

The Bathrooms

The second-most expensive rooms to remodel are the bathrooms—especially the en-suite bathroom. Like the kitchen, evaluate the plumbing under the cabinets, behind the throne, and in the shower or tub.

If there is a jetted tub, fill it with water and run the jets. Check for leaks and black mold coming out of the jets.

Check the linoleum or tile for cracks, stains, and tears. Place your foot near the base of the throne and press down. Does the floor feel soft? Does the toilet wobble? These may be indicators of water damage in the subfloor, which will require an expensive repair. Repeat this test on the floor near the showers and bathtubs. Lastly, check for the bathroom outlets for GFCI circuits.

The Primary Bedroom

Besides the kitchen, the primary bedroom is the main focal point of a home for most buyers. So it must be in tip-top shape after the remodel.

Don’t get too hung up on the current condition of the bedrooms because you’re probably going to replace all the flooring and paint the walls anyway. You are mainly checking the size and shape of the room. Is it large enough for a king-sized bed, end tables, and a dresser? Does it get decent light, or do you need to add a window or skylight?

Many buyers are looking for primary bedrooms with en-suite bathrooms. Is there a bathroom attached or room to add one? Is the closet a walk-in or large enough for the clothes of two people? If not, is there room to add one?

Note any missing or broken doors, door hardware, and light fixtures on the Fix-and-Flip Property Risk Worksheet.

The Secondary Bedrooms

The condition and size of the secondary bedrooms are less critical than the primary bedroom, but you shouldn’t overlook them. Keep in mind that a three-bedroom home appeals to a larger buyer pool than a two-bedroom, so if the property has less than three bedrooms, you may want to consider the cost of adding another bedroom if the home’s floor plan permits.

Additionally, many people work from home today and are looking for homes with quiet home office spaces.

2. Evaluating a Home’s Exterior

Impatience and excitement can lead you to overlook important details when evaluating your potential fix-and-flip deal. Take the time to inspect the entire exterior and yard thoroughly, even if the interior is in great shape. In my haste, I’ve missed structural cracks that would have been easily spotted had I taken the time to walk around the entire property with a critical eye.

While inspecting the exterior, look for cracks and sagging windows and doors. These are signs of settling in the foundation and could be signs of a much more significant and costly problem.

If you brought a ladder, take a peek at the roof. Are there missing, damaged, or curled roofing shingles? Are the gutters and downspouts attached? Do you see any water damage to the fascia and siding?

How are the siding and paint? Flaking paint and damaged siding will need to be repaired and painted. Will the current paint color attract the attention of a modern buyer?

Check the windows and exterior doors. Are they operational and energy-efficient? New windows and doors can dramatically change a home.

Evaluate the Yard, Driveway & Lot

Are the driveway and patio unlevel or cracked? How is the size and shape of the lot? Is it level and graded properly?

Walk the entire yard. Does it need a new sprinkler and sod? Are there any dead trees or bushes that will need to be removed or replaced?

Are there obstructed views, noisy roads, nearby utilities, or a lack of privacy that may affect the resale value?

Is there trash or junk that may be left behind? My experience has been that no matter the agreement, homes and yards full of trash and debris are still full of trash and debris after the occupant moves out.

Write all your concerns on the worksheet.

3. Evaluating a Home’s Mechanical Systems

You must always inspect the basic mechanical systems, including the heating, cooling, plumbing, and electrical systems. Some properties may also have swimming pools, hot tubs, fireplaces, wells, and septic systems. Make sure to inspect all of them thoroughly.

Keep in mind that when you’re buying a property to flip, you’re most likely making an as-is offer to a seller who doesn’t have the desire or the ability to make repairs. To get top dollar for your fix and flip, you need to convince buyers that you didn’t just make the place look nice—you also addressed mechanical and structural issues.

When possible, have professionals inspect the property’s mechanicals, sewer line, and septic system for their functionality and lifespan when you’re flipping homes. While this may cost you a few hundred dollars today, it may save you thousands down the road.

In some instances, as in a foreclosure, you won’t have the time or opportunity to have these items inspected by a professional. Therefore, you will have to make some educated assumptions about their age and functionality and adjust your offer price for the additional risk of buying the home without in-depth knowledge of their condition.

When flipping homes, always err on the side of caution. For example, if the furnace and water heater are more than 20 years old, assume you will need to replace them to sell a safe and reliable property to the new buyer.

Evaluate each mechanical item and score them on your worksheet.

4. Evaluating Other Factors

Once you’ve completed your evaluation of the physical condition of the property, don’t forget to look into the zoning, flood zones, homeowner associations (HOAs), property taxes, and local sales tax. When overlooked, these items can cause you a lot of headaches or eat up all your profits.

Many investors who are new to flipping homes make the mistake of buying properties to rent them as short-term rentals. Unfortunately, many investors are unaware of local ordinances or HOA rules on short-term rentals—or simply ignore them—only to find out later that they’re prohibited from vacation renting the home.

On the other hand, savvy investors understand that by overcoming obstacles, they can take a low-value property and turn it into massive profits. Knowing how various factors can impact a property’s value can help you avoid big mistakes and turn other people’s lemons into lemonade.

Bottom Line

My approach to flipping homes takes the emotion out of the process, forcing you to slow down and think carefully, so you can focus on getting the best ROI for yourself or your investor clients. Taking a cautious approach to flipping homes will prevent you from overpaying, or worse—buying a property with extensive damage you may have overlooked. My Fix-and-Flip Evaluation Process and Fix-and-Flip Property Risk Worksheet have prevented me from making costly mistakes, and I hope these serve you just as well.

Add comment