A comparative market analysis (CMA) determines the market value of a property by comparing it to similar properties that have recently sold, as well as to those currently listed for sale. A CMA is a crucial tool for listing agents determining the right sale price for a property. It also helps buyer’s agents advise their clients to make competitive offers.

Conducting accurate, consistent CMAs isn’t easy, and most agents aren’t taught this skill in their prelicensing real estate classes. The key to a good CMA is, above all, thorough research. Let the data guide you, along with your keen real estate eye. Our team has put together hundreds of CMAs—and we’ve developed a bulletproof process we’re sharing with our readers.

If you want to follow along, make a copy of our free CMA worksheet template and fill in each section as you move through this comprehensive guide.

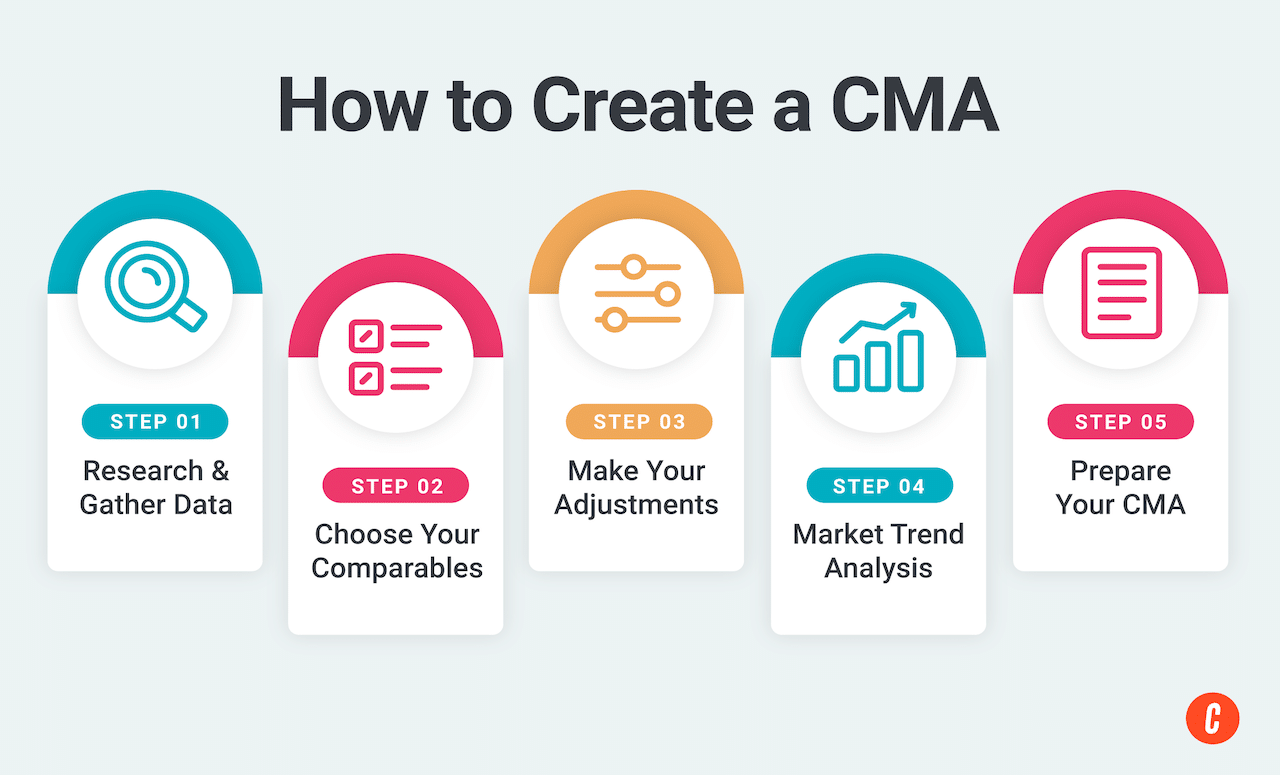

How to Do a Comparative Market Analysis in 5 Steps

1. Do Your Research & Gather Your Data

The first step to creating a CMA is to gather all the information you can about the property you want to evaluate as well as other properties that are similar to it. If you want to determine a home’s value, much less sell it, you need to be an expert when it comes to every detail. The more you know about a property and how it compares to the rest of the market, the easier time you’ll have arriving at the perfect price range.

Start With Public Records for Historical Data

These sources tend to have the most accurate data and usually offer the easiest way to build the foundation of your CMA. Most MLSs connect to a public records database, like Corelogic’s Realist or another software like Propertyradar, that will provide you with all of the public record info.

You’re looking for background data to set your foundation. Think homeowners association (HOA) fees, property taxes and—in certain states—even mortgage information (which gives you an insight into equity). Having this information can help you stand out from the competition with your CMA. This foundation sets you up to compare the property taxes and HOA fees to the comps to easily see how your subject property stacks up.

Gather Your Information on the Subject Property

Start with the data you can find on the subject property. For example, when was it last sold, how long was it on the market, and what was the selling price? Does the current seller have equity to roll into another property? All of this info enables you to paint a picture of the subject property. Don’t forget to view the pictures—don’t just work on raw data alone.

You’ll need to be able to explain the data to your clients, so you’ll need to have the full picture for yourself. Preparation is key. Here’s a list of items to include and why they matter:

- Location: Try to select comps that are in the same building, subdivision, or neighborhood. If you’re not able to find comps nearby, try to use an area that shares the same school district, crime rate, and proximity to local amenities like a recreation center.

- Year built: Architectural design and building materials tend to change every few years. Developers use different firms to design their homes. Ensuring that your comps are within the same age is important to establishing the price.

- Square footage: This is especially important in urban markets where price per square foot (PSF) is a top factor. If the square footage seems off, check for annexes on the lot. Also, make sure you’re comparing apples to apples for all your comps. You might see three different square footage totals. Total square footage means something different than liveable square footage—for example, an unfinished basement is not considered liveable square footage.

- Bedrooms: Bedrooms matter, but keep the type of bedroom in mind. After all, primary bedrooms with a five-piece en suite bathroom are more valuable than a standard bedroom. You can be a bit flexible here, but do use the number of bedrooms to help narrow down your comps. This is where the art of the CMA comes into play. Let’s say you’re narrowing down your comps and need to pick between two properties that are off by one bedroom but in the same building or neighborhood. Your rule of thumb is to match bedrooms if at all possible.

- Bathrooms: Again, you need to compare apples to apples. Use precision here: A half bath is a toilet and a sink, a three-quarter bath has a standing shower (but no tub). A full bath is not the same as a full five-piece en suite with double sinks.

- Special features: We’re not talking about a gold toilet here. Although I’ve heard those are pretty cool. Special features that actually add value might include fireplaces or high-end landscaping.

- Condition: In an appraisal, a property is usually listed in great, good, decent, or poor condition. Some appraisers will use a matrix to determine this. Agents generally use the photos to suggest the condition. After all, a picture is worth 1,000 words—especially when it comes to real estate.

- Property taxes: Property taxes can rise quickly over the course of just a few years, especially in areas that are booming. Check the taxes of your comps and make sure they’re similar—they are a component in every buyer’s budget, whether they finance the purchase or not.

- HOA (if applicable): Like taxes, HOA fees and regulations usually only increase. And if there’s a special assessment on the property or on the horizon, that could add hundreds of dollars to the monthly payment. Take a look at some of the closest comps in the building or neighborhood to see if they have any special assessments noted in the listings.

- Lot size (if applicable): If a lot is twice as large, the property taxes will be higher. However, a small home on a larger lot means there might be room to expand the house itself, which can be a boon—especially to investors.

- Basement (if applicable): Don’t just gloss over a basement; it can add a lot of liveable square footage to a home, especially if it’s finished or partially finished. However, in many markets, when a basement is unfinished, it does not count as square footage. Keep this in mind if you see discrepancies in square footage on your comps.

- Garage (if applicable): If the subject property is a condo, make sure to note if a parking spot comes with the unit. In those cases, garage spots can be valued at $50,000 or more. And in a location with harsh winters, people want to know they’ve got a safe and warm place for their car.

- Time on market: This can tell you a lot about the pricing trends of your comps—especially expired listings. If the average time on market for the area is only 15 days and you find a comp that was on the market for 40 days, dig into that listing to find out what happened. Maybe it fell out of contract, or maybe it was just overpriced.

- Price adjustments: If a comp went through three price cuts before it sold, that’s good information to have. It helps to make your case when illustrating the pricing range you present to your clients.

- Closing price (and concessions): This can differ from list price—sometimes in the tens of thousands of dollars. If you see a major change, you should make a note of that. Once a listing has closed, the MLS will tell you if a concession was made. If so, you can try to dig in to investigate why. For example, if the list price was comparatively high, the sellers may have made a price concession during appraisal to keep the deal moving.

- Date of sale: Seasonal changes play a part in real estate too. In general, the market is hot in the spring and slows down in the fall, when people get settled into school districts and start their holiday planning. A home sold in the dead of winter in the Midwest might have fetched another $20,000 depending on timing.

- Price: Keep in mind that prices fluctuate and can even vary week to week. Clients are counting on you to have the most accurate data possible to ensure they’re getting top dollar (or not overpaying, if they’re buyers).

Pro Tip

The owner of the home will have intimate knowledge of specifics, so try to speak with them about any special features of the house if you’re able. Ask questions like, “Is there anything that I should know about that might not be visible from the historical data?”

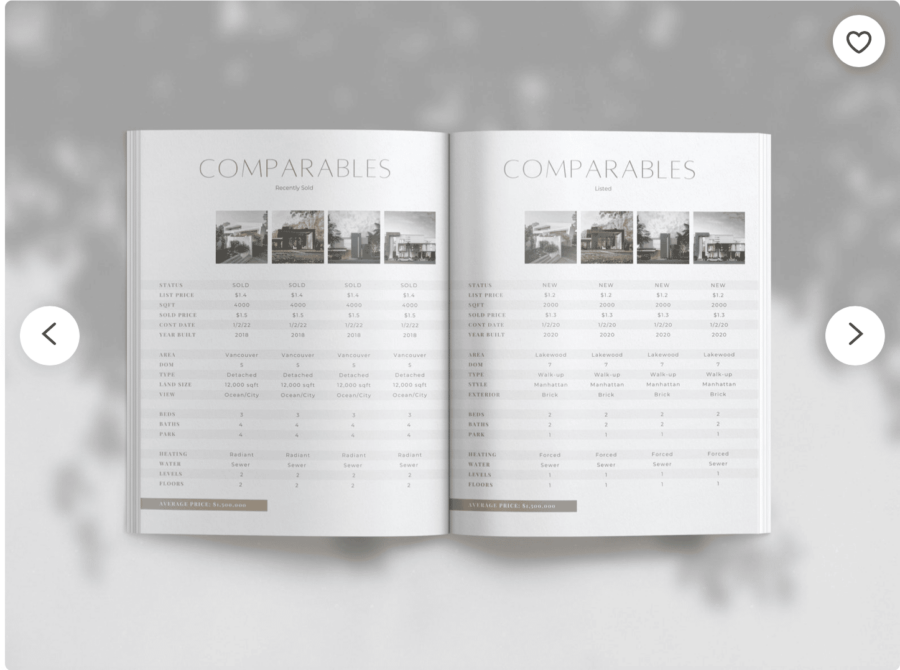

2. Gather & Select Your Comparable Properties

Now we need to find comparable properties that are as close to the subject property as possible. Active listings are great to see the current market, but the sold properties will give you an insight on real pricing trends.

We’re going to work backward here—I see agents try to sniff out an exact comp on the MLS, but instead of sifting through tables of data, let’s start with the map drawing tool in your MLS to sketch out the area where you’re going to pull your comps. This way, you won’t pull your hair out trying to find an exact match. Once you’ve drawn your lines, use a filter to narrow down the number of bedrooms and go back six months. This should return a decent number of results. Now you can filter down by number of bathrooms, then go down to three months to narrow your list.

The balance here for your comps is a match as close as possible, without going too far back in time (usually three to six months). As most agents know, pricing data tends to be hyperlocal. If you’re looking at neighborhood trends, you might have to go back up to a year to find some good comps. However, if you’re too picky about an exact match and you go back too far, you’ll actually be providing less accurate data—always consider the fluctuation in the market.

Make a copy of our free CMA worksheet template and fill in the blanks on the second tab:

Selecting Comparable Properties Is an Art, Not a Science

Thinking outside the box is important here. You have all the data at your fingertips to make the most informed decision possible for your client. Don’t select the first three properties you see that sold on the street in the last month. Take the time to really curate a great selection of about five or six good choices. Dive into the details that make each property unique to ensure you’re selecting quality comps. Mix in a couple of active listings to paint the picture for your clients of how the market is currently performing.

When you’re selecting comps, it’s more than just crunching numbers or ticking boxes on properties that match the number of bedrooms. Appraisers often don’t consider updated kitchens or high-end furnishings when considering the value of a home—but clients do. These features can significantly influence the perception of the home (and how much potential buyers are willing to pay). Choose comps that highlight the property and provide realistic expectations.

3. Make Your Adjustments

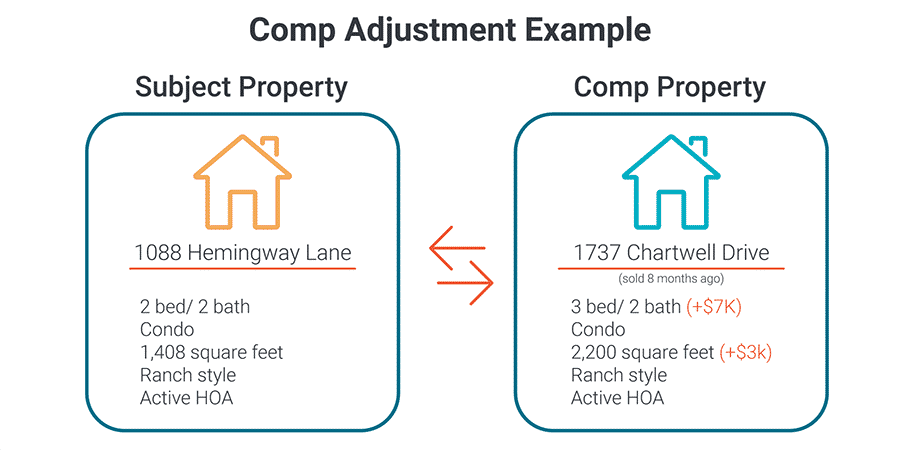

Sometimes finding good comps is a challenge. You’ve zoomed out on your map view and gone back a year, but still can’t find more than two comps. In situations like this, you’ll need to make some value adjustments relative to the subject property. Time to roll up our sleeves and do some napkin math.

Let’s take a look at what an adjustment might look like where a subject property has one less bedroom than the comparable property. You need to adjust the price to estimate what that comp would have sold for without that extra bedroom.

Empower & Enlighten Your Clients Through Your Adjustments

This is a chance for you to showcase your skills to your clients to illustrate why you made the adjustments. Speak to the local trends and what you’ve seen in the market from your research. Nearly every CMA is going to have some properties that aren’t an exact match to the subject property. After all, every single home is different. It’s best to note these differences and make a suggestion on the price adjustment. However, you should empower your client to draw their own conclusions when you present your CMA. This is especially important if you haven’t yet seen the subject property for yourself.

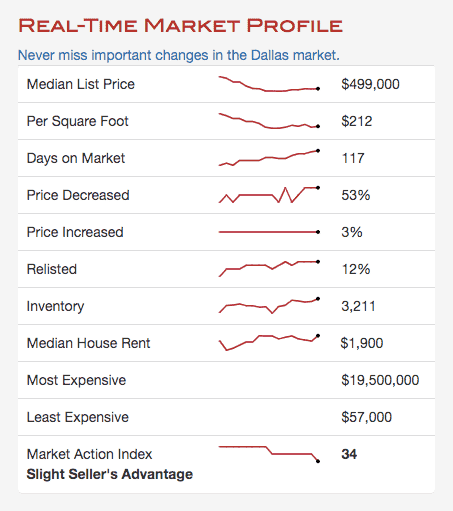

4. Conduct Your Market Trend Analysis & Find Your Range

Once you have all the information you need at your fingertips, it’s time to consider trends. After all, if they just wanted a list of comps, your clients could find that themselves on Zillow.

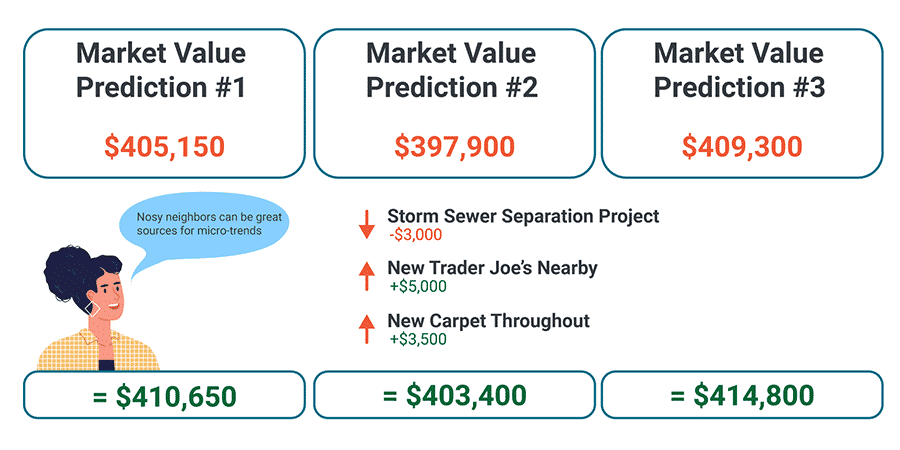

Let’s say there’s major road construction down the block from the subject property. Despite an overall trend of price increases improving in the neighborhood, this micro market trend may drive down the final number on your CMA.

While agents need to be informed on what’s happening week by week, it’s (admittedly) impossible to stay updated on everything. After all, there are more than 18,500 neighborhoods in the United States, and they aren’t just divided by ZIP codes. You’ve pulled the data—now it’s time to interpret it to see how your findings line up.

Try using a tool like market reports from Altos Research to help back up the local trends you’re seeing from the comps you’ve researched. The picture should start falling into place now. For example, now you can see how the number of days on market has been steadily increasing for weeks, which can help inform your pricing recommendation.

Pro Tip

Set up regular market stat reports from your MLS or another tool for your own neighborhood, your farm, and areas where you have clients ready to move. Be proactive about keeping your finger on the pulse!

Make an Informed Analysis Based on Your Client’s Situation

If you’ve been thorough and consistent in your market research, you should see a trend emerge from your comps. Because the fair market value for any given subject property tends to be subjective, I suggest providing a reasonable range.

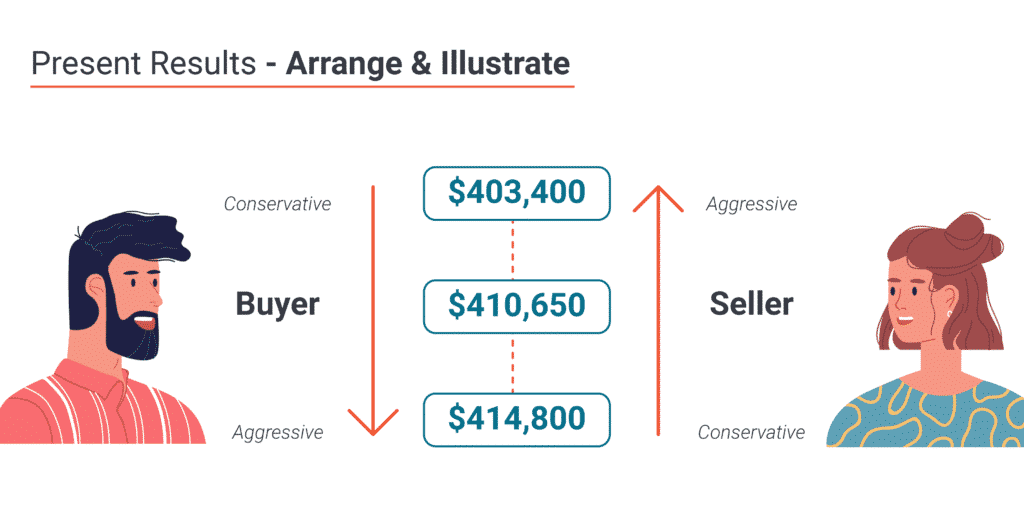

You can get a small, informed range by organizing these numbers from lowest to highest to get a conservative, moderate, and aggressive market value for your subject property. This way, you can explain the numbers in a way your clients can easily understand.

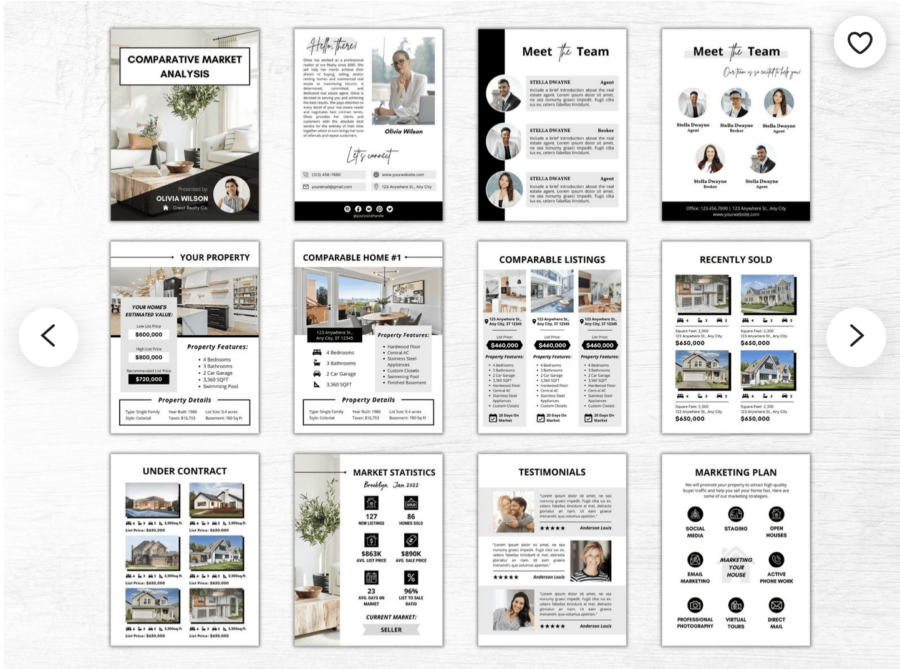

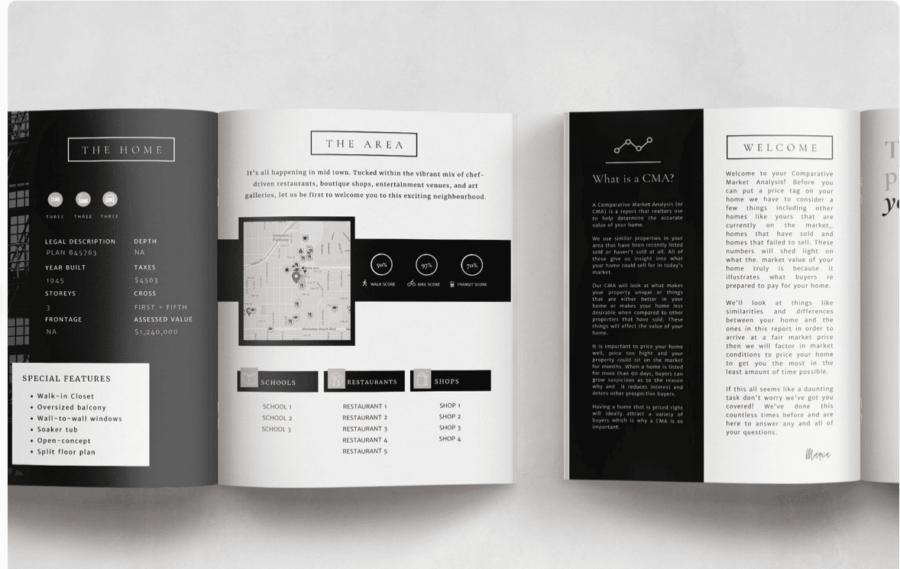

5. Prepare & Present Your CMA Report

Now it’s time to whip up some magic. Your clients need a presentation, they need context, and most of all, they need to understand how you got to the answer you’ve provided. This is your chance to showcase your branding, your knowledge, and your authority as an agent.

You can make a copy of our worksheet for buyer CMAs, but your CMA for sellers and listing appointments should include other elements, such as:

- Your short bio and how to connect

- Subject property highlight (e.g., bedrooms, bathrooms, square footage)

- Your top three comparables

- Recently sold and under contract properties (showcase the differences)

- Neighborhood profile

- Market statistics (average days on market, price per square foot)

- Marketing plan

- Testimonials

Let’s take a look at some of our favorite examples and templates in the next section.

CMA Templates & Examples

CMAs are a lot of work, but they don’t have to be boring. Poring over a table of data is an easy way to lose your clients’ attention—you’ll see their eyes glaze over in record time.

Software like Cloud CMA make it simple to design aesthetically pleasing CMAs. You can also whip up your own on Canva or use premade templates on Etsy. Here are examples that are comprehensive, clear, elegant, and sure to wow. Remember, keep it simple and focus on guiding your clients through the data.

Comparative Market Analysis FAQs

Even though you’re now an expert in comparative market analysis, here are some questions I get asked about CMAs (and helpful answers).

What’s the difference between a comparative market analysis & an appraisal?

An appraisal is performed by a licensed appraiser who uses closed sales to understand the current value of a property, usually for the purpose of lending or insurance. A comparative market analysis is performed by a real estate agent or broker for the purpose of determining a list or offer price based on comparable sales and market trends.

How many comparables should I use in my comparative market analysis?

The more comps, the better. Actually, I should temper that by saying, the more comps, the better—as long as they’re accurate.

There is often a temptation to use a ton of comps when doing a CMA, but in doing so, it’s easy to include a property that isn’t quite similar enough to your subject property. Remember, making apples-to-apples comparisons is key to the CMA process. A good number of comps is between four and six, including one or two active listings.

What’s the most important property trait to consider in my comparative market analysis?

Location plays the most important role in determining the value of a property. A property’s location determines how far it is from schools, hospitals, and the beach. It also determines the home’s property taxes. When seeking comparable properties to use in a CMA, finding ones with equivalent locations is a must.

Where should I get my comps data for my comparable market analysis?

Start with your historical data to set your foundation, then move onto your MLS. Your MLS will have clear, detailed information that’s most relevant to real estate agents.

Try to steer clear of Zillow, Redfin, and the rest. Third-party sites often don’t provide a history of a property’s price changes and total days on market. You’ll want to consider both items when finding comps for your comparative market analysis.

What if my property is vacant land?

Vacant land is tricky. You have to examine zoning options, highest and best use, utility availability, and more. Also, vacant land prices are closely tied to construction rates and demand. I would recommend talking to your broker for guidance on specific sites.

The range of my three numbers is too wide. What should I do?

Every market is different, and prices have fluctuated a lot in the last few years. Your range should be between the lowest number you expect your clients to accept and the highest number you believe the market will bear. Don’t provide a range that’s too broad to be helpful. They can find a broad range at lots of places online.

If you’ve got a broad range that you’re struggling with, it’s usually an indicator of one of two things: your comps aren’t similar enough to your subject property or you’re not taking market trends into consideration. They’re seeking your expertise. Go back to the drawing board to trace your steps. It might take a few times. And, of course, your client’s circumstances will affect the range—especially between buyers and sellers.

How do broad economic trends impact the value of my real estate CMA?

There’s only one constant in real estate—change. We’ve seen record price spikes in certain areas over the last few years that few could have expected. Since you will probably encounter some form of this question from clients, be prepared with your talking points. It’s your duty as a real estate professional to stay up to date on local trends in your market, including interest rates, employment data, and local economic growth forecasts.

How can I effectively communicate the results of my CMA to my clients?

A CMA usually serves as the basis of your pricing discussion with sellers—or helping your buyer make an informed offer. It’s always best to walk them through your CMA so that if their expectations don’t line up, you can explain your thought process.

Let this be a communication between both parties. After all, they have a number in mind. Listen to how they got there to see if you can coach them through their expectations. This helps your client understand things from your perspective. Stand behind your process—after all, you’re the real estate professional.

My results are different from my colleague’s results. What gives?

Even though a comparative market analysis uses objective information like square footage, acreage, bedroom count, and the like, it’s ultimately a tool that relies on subjective feedback from you, the real estate professional.

For example, when you’re considering a comp that’s similar to your subject property in every way except that it has an extra bathroom, what value do you assign that bathroom in your adjustment? Your colleague may adjust it differently than you do, or perhaps, not even choose that comp in the first place.

If your conclusions are different from other real estate agents, don’t fret. The market will demonstrate who was closer to the actual value. Trust in your process, and if the market gives you constructive feedback about your final numbers, find where you need to make an adjustment in your CMA process to make your next one even better.

Bringing It All Together

Learning how to do a comparative market analysis isn’t easy, but now you have a thorough understanding of how to estimate the value of a property in your market. Take this information to make your sellers’ list prices more accurate and your buyers’ offers more competitive. Have any tips or specific questions? Leave them in the comment section below!