Opportunity buyers are hunting for distressed office sellers across San Francisco.

LendingClub, a locally based fintech firm, bought a 22-story, 234,000-square-foot office tower at 88 Kearny Street in the Financial District for $74.5 million, for its headquarters, the San Francisco Chronicle reported. The seller was the Teachers Insurance and Annuity Association of America.

The deal works out to or $318 per square foot.

The TIAA bought the building in 1999 for $65.7 million, or $281 per square foot. Brokers Kyle Kovac and Mike Taquino of CBRE represented the seller in the deal. Century Urban Partners advised the buyer.

LendingClub now leases offices for its hub a block away at 595 Market Street, but the lease is set to expire next year.

Kovac said the deal marks a “growing” trend since the pandemic of “owner-user” purchases across the city and the Bay Area.

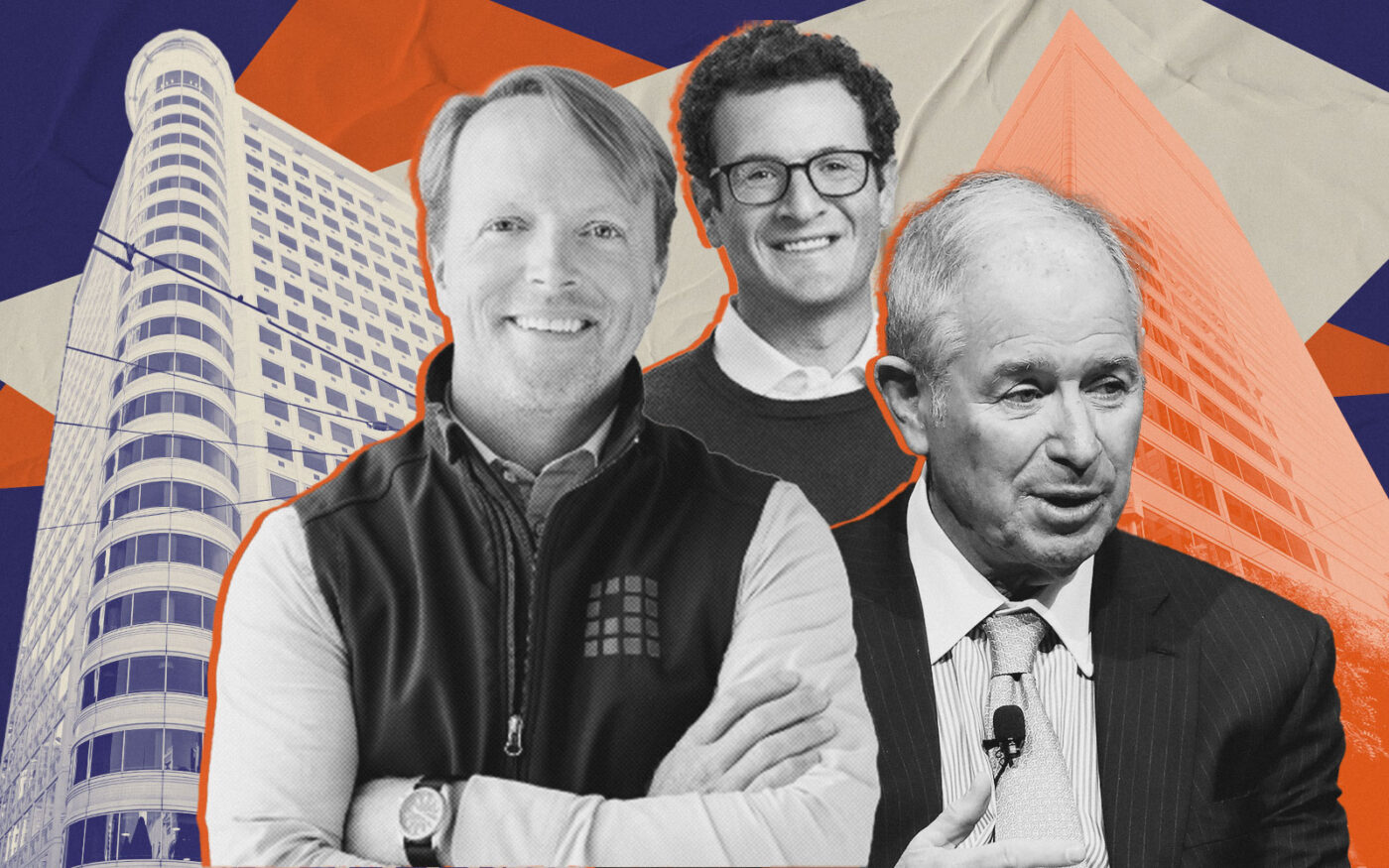

Meanwhile, locally based Shorenstein and New York-based Blackstone are poised to list a 34-story, 690,000-square-foot tower struggling with rising vacancy at 45 Fremont Street. A pending asking price was not disclosed.

Multiple market insiders told the Chronicle its owners face pressure to offload the property from lender Bank of America, which in 2019 provided a $347 million loan secured by the property.

Slack, the building’s anchor tenant, in 2022 listed all of its 13 floors for sublease. The building is now more than 50 percent vacant, according to one unidentified source.

Blackstone, which in 2017 bought a 49.6 percent stake for $230 million, has faced an uphill economic battle with the building. Shorenstein also faces mounting financial pressure, laying off executives this year after facing up to 7 million square feet of distressed office buildings.

“We wrote our investment in 45 Fremont down to zero two years ago given the well-known headwinds facing U.S. traditional office buildings at the time,” an unidentified Blackstone spokesperson told the newspaper. “Today, we’re confident in the recovery of San Francisco, where leasing activity is improving meaningfully.”

The asking price will likely mirror recent sales of once-coveted office properties that traded for for half their pre-pandemic values, or less, according to the Chronicle.

The discounted deals are creating new opportunities for office tenants to become property owners, while luring non-institutional investors that were previously priced out of the San Francisco market.

Office values across downtown are believed to have bottomed out last year, with Financial District office towers selling for an average of about $310 per square foot — far less than the typical $800 per square foot before the pandemic, according to CBRE.— Dana Bartholomew

Read more