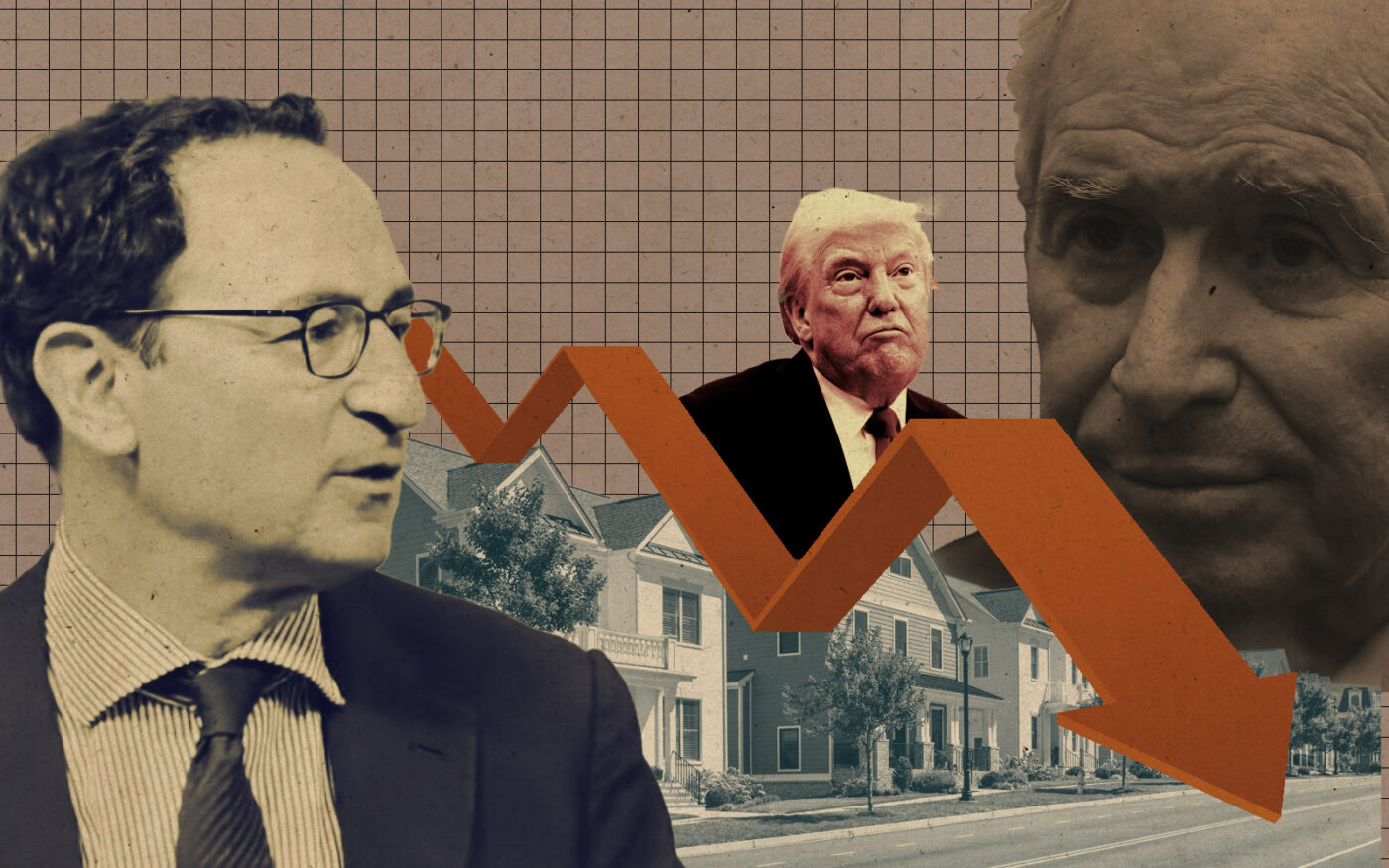

Blackstone executives on Thursday morning took a crack at the question that has consumed the industry for the past two weeks and for which it has yet to find an answer: How will real estate respond to President Donald Trump’s tariffs?

“My gut is this period of time may slow some of the movement towards real estate,” Chief Operating Officer Jon Gray said on the alternative asset manager’s first quarter earnings call.

It’s a sobering outlook and a tough pill to swallow for an industry Blackstone itself said was poised for a comeback after a couple of years in the rate-hike-induced doldrums.

But it’s also a straight take, a much-needed sliver of clarity for an industry that has either stayed mum or offered milquetoast commentary on how a trade war and its possible knock-on effects — supply chain upheaval, inflation, rate hikes and recession — could help or hurt dealmaking.

By Gray’s reasoning, real estate is still an underperformer, and when markets get dicey, “you tend to see less allocation to those sectors.”

As Trump geared up for “Liberation Day” through the first quarter, Blackstone’s distributable earnings for its real estate segment slid 20 percent year over year to $495 million — the greatest drop-off in a four-quarter streak of declines and a sign of soft sales activity.

Net realizations or profits pocketed from exiting investments plunged 65 percent in the period to $10.5 million. And the behemoth’s real estate assets under management shrank 5.6 percent to $320 billion in the quarter compared to last year.

As a whole, though, the firm posted strong results for the quarter: distributable earnings of $1.09 per share — an 11 percent pop year over year, and revenue of $2.76 billion, an 8 percent increase. Blackstone also reported the highest level of fresh investment in nearly three years.

Amid real estate’s results and Gray’s broad-stroke outlook, CEO Stephen Schwarzman did highlight a few silver linings to the tariff mayhem, albeit from a 10,000-foot view.

Tariffs will likely drive up construction costs and stymie new supply, he said. That’s a boon for real estate values, particularly in logistics and apartments, Blackstone’s two largest sectors and asset classes where development has dipped to decade-long lows.

But that thesis only pans out “absent recessionary conditions,” Schwarzman cautioned. And recession, amid Trump’s whipsaw trade policy, is very much back on the menu.

Blackstone may own real estate, but it’s not a pure-play REIT; it’s an international investment firm. And amid the segment-level projections, the upshot of the call was one that has reverberated across the finance industry since April 2.

“We believe a fast resolution [of this period of uncertainty] is critical to mitigate risks and keep the economy on a growth path,” Schwarzman said.

Read more