Bank OZK says it’s in “no hurry” to sell off the northern half of Lincoln Yards, the long-stalled megaproject on Chicago’s North Side, but that patience comes at a steep price.

The Arkansas-based lender disclosed during its earnings call Thursday that it’s fielding interest from developers for the 27-acre site it seized from Sterling Bay in March, but emphasized it’s committed to finding a buyer with “the capital and the expertise” to take on the city-approved master plan, Crain’s reported.

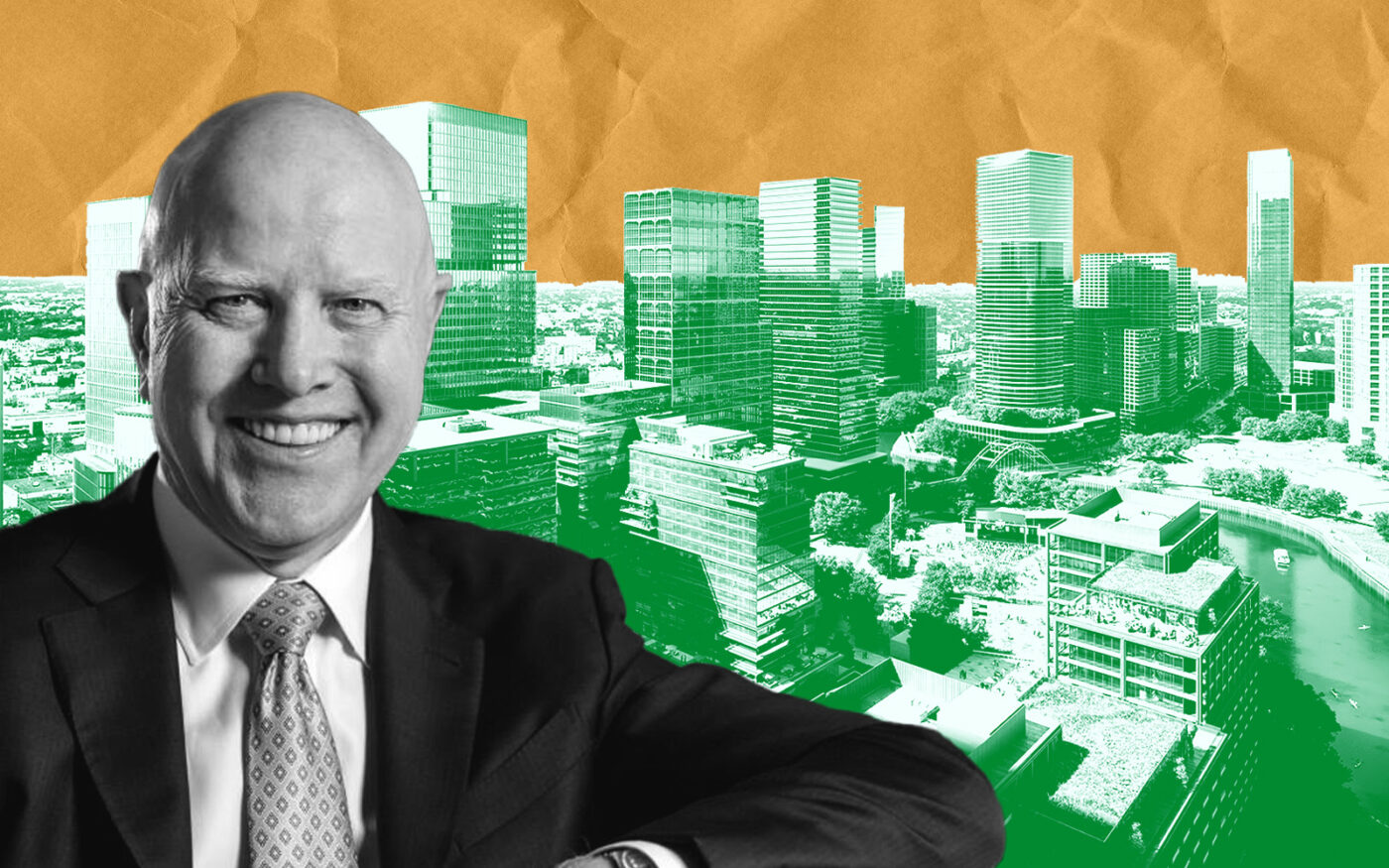

CEO George Gleason added the bank is prepared “to be as patient as we need to be” to get there.

It’s the first public comment from the lender since taking control of the land to resolve a $128 million delinquent loan, and the clearest signal yet that the bank is now calling the shots on how one of Chicago’s biggest development sites moves forward.

Behind that calm tone is nearly $38 million in writedowns, which OZK booked after placing Sterling Bay’s loan on non-accrual status last year and acknowledging that a large portion would likely never be repaid.

Meanwhile, city officials claim Sterling Bay’s handover of the site violated its 2019 redevelopment agreement tied to a total of $490 million in TIF funding. On April 1, the planning department issued a notice of default, calling the move a breach. While the deal hasn’t been terminated, officials said they’re evaluating whether Bank OZK can bring in a new developer or if the agreement needs to be restructured entirely.

That followed months of missed deadlines, failed capital raises and the quiet exits of backers Lone Star Funds and JPMorgan Asset Management, who had been shopping their stakes at a discount.

Sterling Bay planned Lincoln Yards as a $6 billion mixed-use development covering 53 acres along the Chicago River. The project aimed to create a hub that would connect the adjacent neighborhoods of Lincoln Park, Bucktown and Wicker Park, with an ultimate goal of 14.5 million square feet of development.

The firm still controls the southern half of Lincoln Yards. That includes a 320,000-square-foot life sciences building at 1229 West Concord Place, which Bank OZK also financed with a $125 million construction loan. That loan matures later this year, and the building is vacant.

The city has signaled it plans “deeper conversations” with Bank OZK about the future of the site, which is underpinned by hundreds of millions in potential TIF-funded infrastructure. But the process could take time, especially as any buyer would inherit not only complex entitlements but the political baggage of a failed megaproject once pitched as transformational.

— Judah Duke

Read more