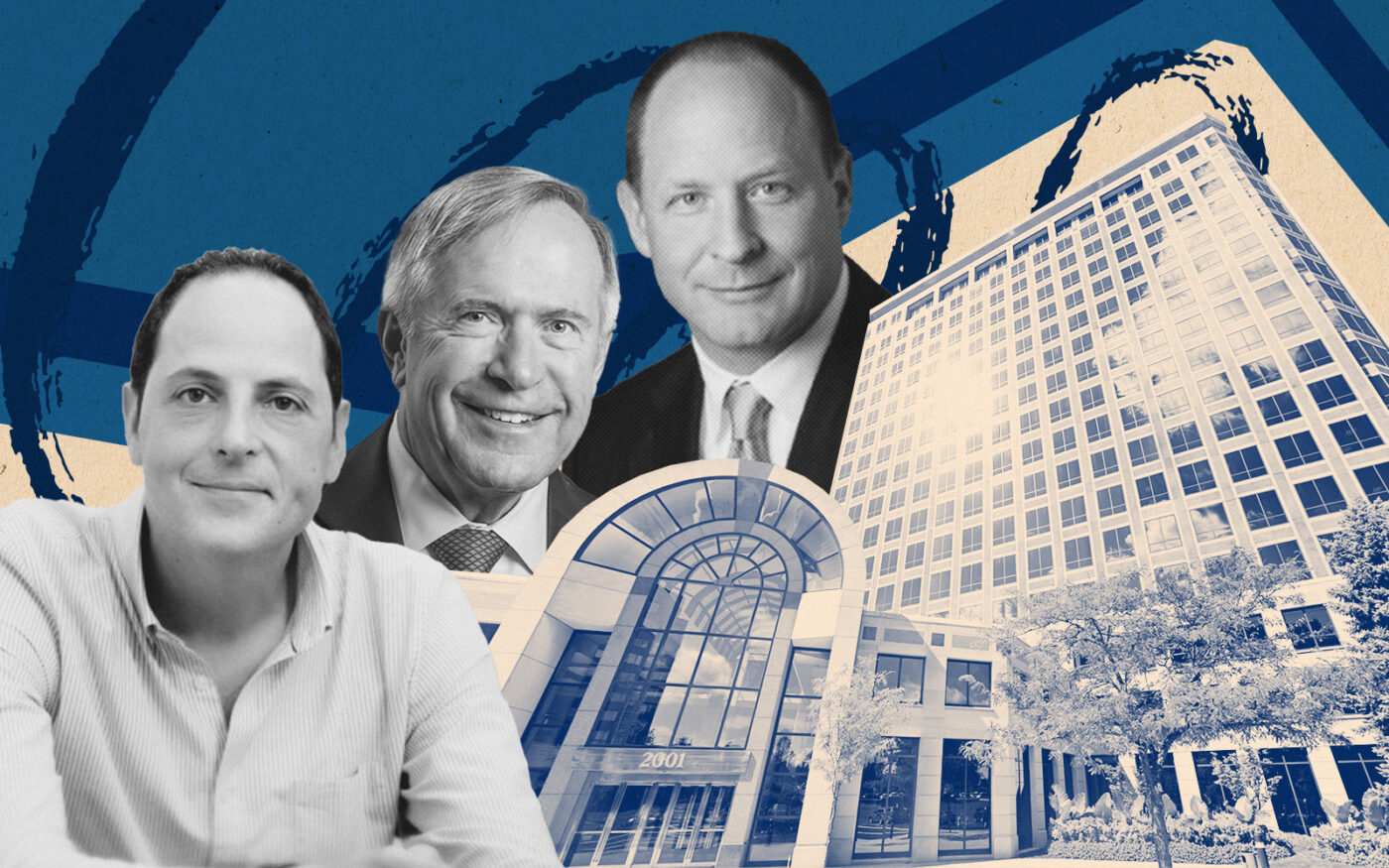

Hamilton Partners is maneuvering to save a struggling suburban Chicago office deal without getting much help from its distressed ownership companion, Accesso Partners, which faces foreclosures at a handful of properties in the area.

Itasca-based Hamilton is a minority owner of the Esplanade I, a 609,000-square-foot office complex at 2001 Butterfield Road in Downers Grove, a property that had its $69 million loan transferred last month to special servicer CW Capital, a sign of financial trouble for the landlord.

Accesso, based in the Miami suburb of Hallandale Beach, has the larger ownership stake in the 19-story property of the two firms, but it’s either unable or unwilling to commit the capital necessary to work out the debt trouble alongside Hamilton, said Hamilton partner Ron Lunt.

As a result, Hamilton is seeking to delay the maturity of the property’s loan, which comes due in July of next year, and is starting debt workout talks with CW Capital around how to fund the costs of turning the property around, such as tenant allowances for workspace buildouts and leasing broker commissions, Lunt said.

“We have some lease talks going, but if we’re going to spend a ton of money, we would like to work out an extension of some sort,” Lunt said. “Offices are low priority for lenders today, which is why you need to start the discussion early.”

CW Capital declared the loan is headed toward “imminent monetary default,” although Lunt said the loan terms were only breached on a technicality because its previous loan servicer, Iowa-based Principal, was allowing rents to be collected and debt costs to be paid later in the month than the special servicer.

CW is reviewing Hamilton’s request for a modification to the deal terms, and it’s unclear when it will come to a resolution. Accesso, meanwhile, will have its equity in the property diluted further with each dollar Hamilton kicks into the deal as it attempts to rescue the loan from the brink of distress, Lunt said.

Accesso didn’t return requests for comment. It surrendered its office tower at 20 North Clark Street in the Chicago Loop to its lender earlier this year, and it is also facing a $75 million foreclosure at 200 West Monroe Street, which is next door to a property the firm previously sold at a major loss from its previous purchase price. Accesso made other suburban office investments that recently ended up in foreclosure, too. The firm bought several of those properties from Hamilton, and entered the Esplanade deal in a 2015 joint venture.

Accesso also lost a Houston office portfolio to financial distress last year.

The suburban Chicago property was appraised at $105 million ($172 per square foot) in 2016, when the joint venture’s commercial mortgage-backed securities loan was originated. That’s far more than what it’s likely worth today as interest rates and subdued demand from tenants have eaten into property values. The loan’s $57.3 million balance pencils out to $94 per square foot.

The property’s financial trouble was triggered in part by the 2023 exit of Hillshire Brands, an affiliate of Tyson Foods, that previously leased a 72,000-square-foot annex building that serves as a research and development facility on the Downers Grove campus.

That space hasn’t been refilled, and the asset is only 72 percent leased, about average for suburban Chicago office buildings amid one of the worst downturns of all time for the sector. The lackluster occupancy has sunk the property’s revenue to well below the level required to meet debt service obligations, public loan data shows.

The property’s debt-service coverage ratio was just 0.43 for 2024 through the end of September, loan data compiled by Morningstar Credit shows — anything less than 1.0 is below breakeven, meaning the Esplanade property was bringing in less than half the rent needed to cover its costs.

Still, Hamilton is working with a brokerage team focused on food processing companies to help lease the space Hillshire vacated, with the hope it can get the deal back on track in time to dodge penalties with its lender.

Yet it’ll be vying for tenants with other office properties in the suburbs that have already been through foreclosure or deeply discounted sales in nearby suburban markets, allowing their buyers to offer lower rents in some cases, Lunt noted.

“Major projects in Schaumburg have gone through ownership changes and the bases are all reset, and it makes it tougher competition,” Lunt said.

Read more